NuConta is Nubank's digital account, which offers free transfers to any other account and can be done through the Android and iPhone (iOS) application itself. O dnetc separated some questions and answers about the new RDB model, to avoid doubts about its operation.

Apple will release credit card at no charge and more secure; know

Meet RDB, NuConta's New Investment Model, Nubank's Digital Account Photo: Dvulgao / Nubank

Want to buy a cell phone, TV and other discounted products? Meet the Compare dnetc

Bank Deposit Receipt is a type of investment linked directly to the CDI. These are private physical income securities issued by commercial banks, credit unions, financing companies and which are low risk. The RDB works as follows: You lend your CDI income money to an institution and get it back with interest, almost as a loan.

Therefore, the client only loses this money completely if the company in which the loan was made goes bankrupt. However, the one that enters the Credit Guarantee Fund, which guarantees up to R $ 250 thousand to users in case this loss occurs.

As noted above, the Credit Guarantee Fund is an institution that protects clients' money in the event of a problem with the financial company. As a non-profit creation, which is used as insurance for both institutions and clients, there is no charge or payment for their services. In case something happens to Nubank, each user recovers everything that was applied in RBD up to R $ 250 thousand any higher value will not be reimbursed by the institution.

Money invested in RDB with FGC guarantee Photo: Reproduction / Helito Beggiora

3. What happens to the money deposited in RBD?

All money deposited with NuConta will appear as a balance to the customer, whether it is account deposits, public securities or RBD applications. There is the possibility to track the yield of these applications and, moreover, the money is available for the user to use at any time.

In addition to having FGC protection as a reassurance to customers that their money is safe, RBD continues to secure NuConta's key advantages, such as better yield than savings, free movement and flat taxes.

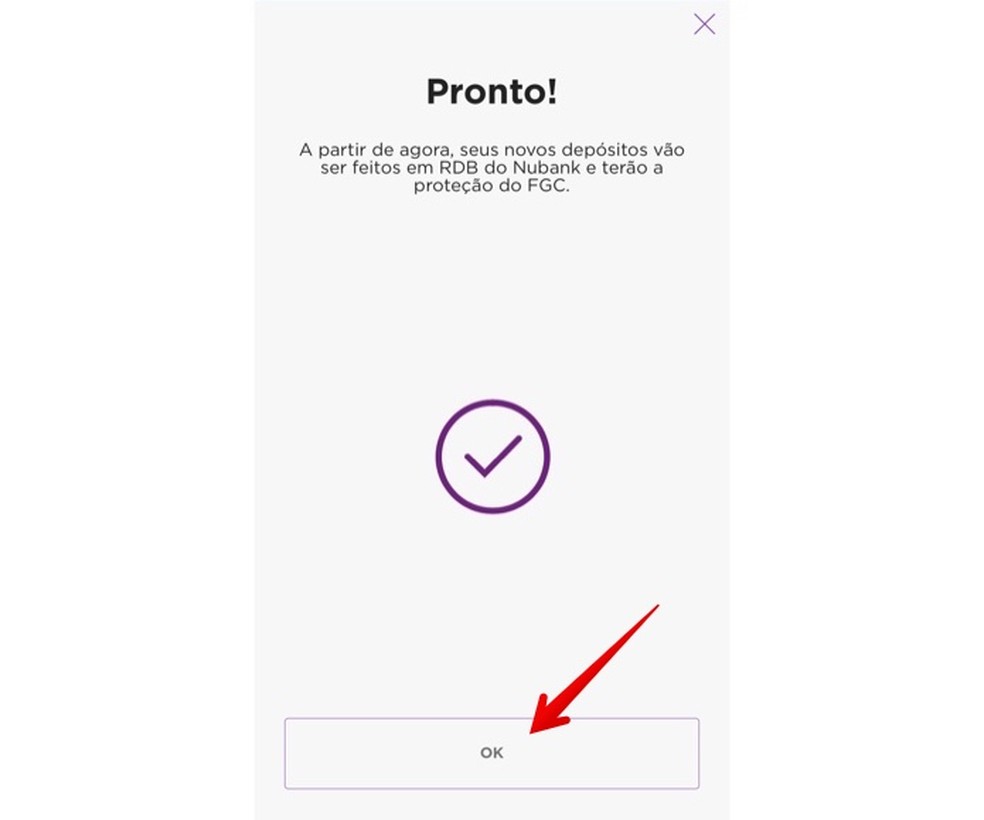

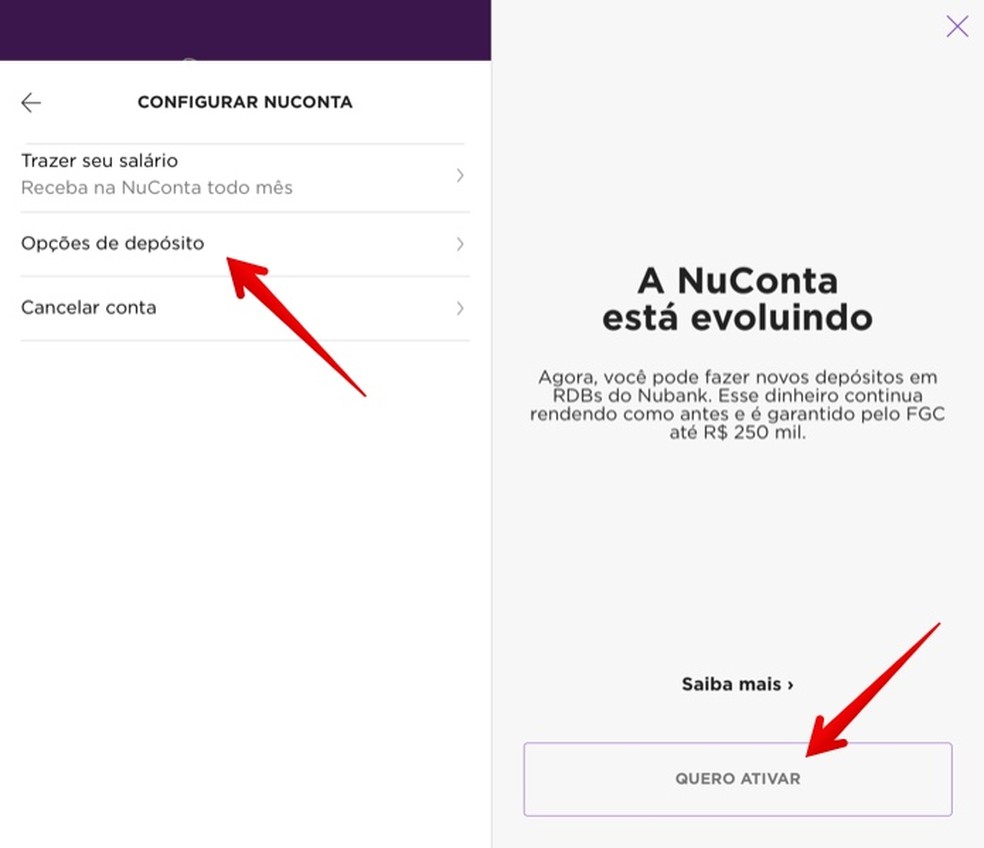

5. How to enable RBD on NuConta?

It is important to note that the customer has full power to choose whether or not to invest their money in RBD. If you want to be part, the user must click on the option "Set up NuAccounts" and then go to "Deposit Options". A screen will appear explaining what, how it works and what the mode is for. After reading, just click "I want to activate".

Activating investments in RDB Photo: Reproduo / Helito Beggiora

Via NuBank and NuBank Blog

How to pay your Uber race with cash