The scam that WhatsApp offers false loans has grown by 198% over the past two years, according to data from the Reclame Here website. Although not new to the messenger, this kind of fraudulent approach took on a new twist in 2019. With the increase in the number of calls fintechs startups of technology that provide financial services In the online credit market, criminals have come to use the name of these companies as bait to lure potential victims.

To get an idea of the size of the problem, in the first nine months of 2019 alone, 683 complaints of this type of scam were recorded, a figure that almost reached the accounting in 2018, which totaled 692 occurrences. In 2017, in turn, there were 350 complaints.

WhatsApp's imitation motorcycle group becomes web hit; see joke

Scam that offers false loan for WhatsApp grows in Brazil Photo: Anna Kellen Bull / dnetc

Want to buy a cell phone, TV and other discounted products? Meet the Compare dnetc

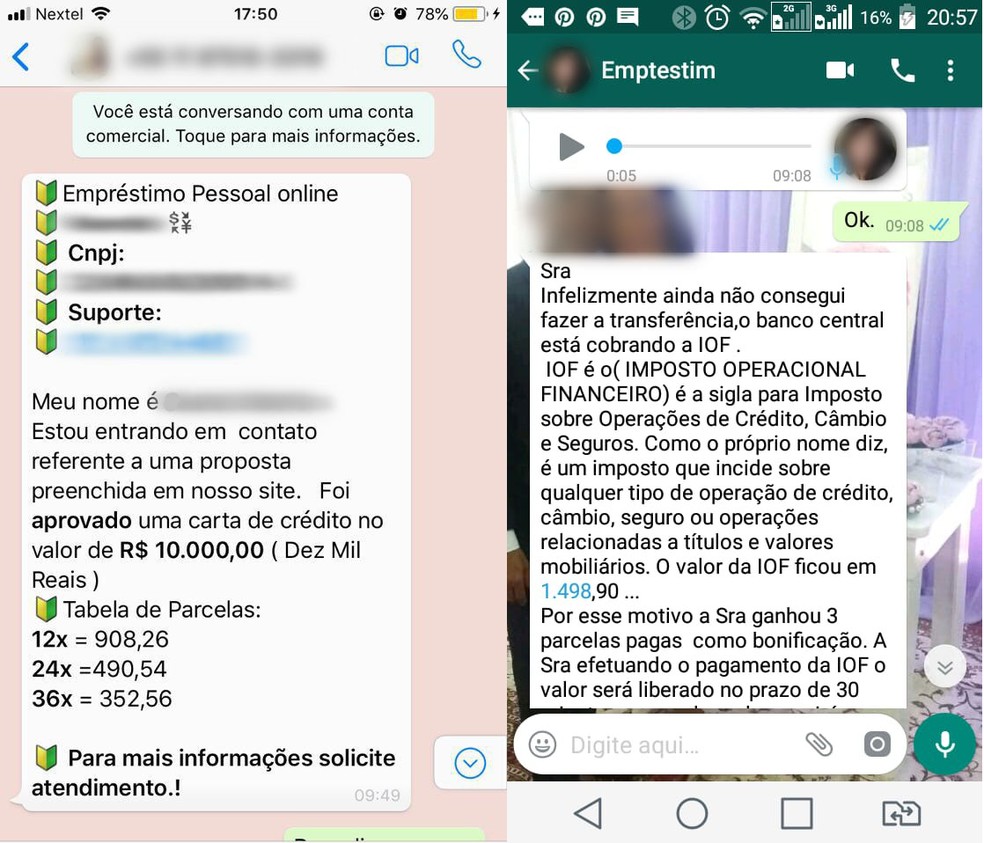

The fake loan offer says it offers numerous facilities like quick cash in large amounts or low interest rates. Despite the different attractions used to deceive the victims, it is possible to draw a profile of the application of the scam.

"The way is always the same: one gets a message on WhatsApp pretending to be a fintech stating that there is a pre-approved credit limit available. However, an advance deposit is required. It's a clear sign of a coup attempt, "explains Dbora Cipolli, chief risk officer for Noverde, an online credit company specializing in C and D classes.

In the scam of the fake loan, criminals offer pre-approved credit and informally approach victims Photo: Divulgao / Noverde

Although it is drawing attention due to the rise of reports on social networks, the scam of the fake loan had already been applied through WhatsApp for at least two years. Until then, cybercriminals used traditional bank names, an approach that changed with the birth of fintechs like Nubank and Noverde.

According to Felipe Ferraz, head of cloud computing at the Center for Advanced Systems Studies in Recife (CESAR), before there was some suspicion of people when the scammer presented himself as a fintech because it is something new and little known. "Today they are growing in volume, users and exposure. Therefore, everyone wants to be part of this wave that is changing the financial market and, unfortunately, has opened the door to malicious people," he explains.

How to avoid falling for the scam

First, never click on links sent by strangers announcing loan offers. Redouble attention to very attractive proposals that call an advance deposit as a "convenience fee" to release a pre-approved amount. This practice is unusual among banks or fintechs.

In addition, it is important to have control over which credit application forms you have completed. Be wary of messages that indicate your credit has been approved with companies that you do not have a relationship with. Still, if you are interested in the offer, please contact the phones available on the company's official pages to confirm the truth of the loan proposal.

Lastly, remember that if the message comes with a lot of grammatical errors or if the service is very informal with WhatsApp audio, for example, there is a high probability of being a scam.

How to unlock WhatsApp with digital; know how to activate