Yesterday Apple released a record profit (for any company, good to note) of $ 18.4 billion in the first fiscal quarter of 2016. At the same time that the result was impressive, there are some "worrying" data there (not for us, users, but for the financial market as a whole who loves to speculate on Apple).

As always after the results are released, the company held an audio conference with the participation of Tim Cook (CEO, or executive director) and Luca Maestri (CFO, or CFO) to give more details of the quarter itself. Below, you can see all the highlights:

General comments

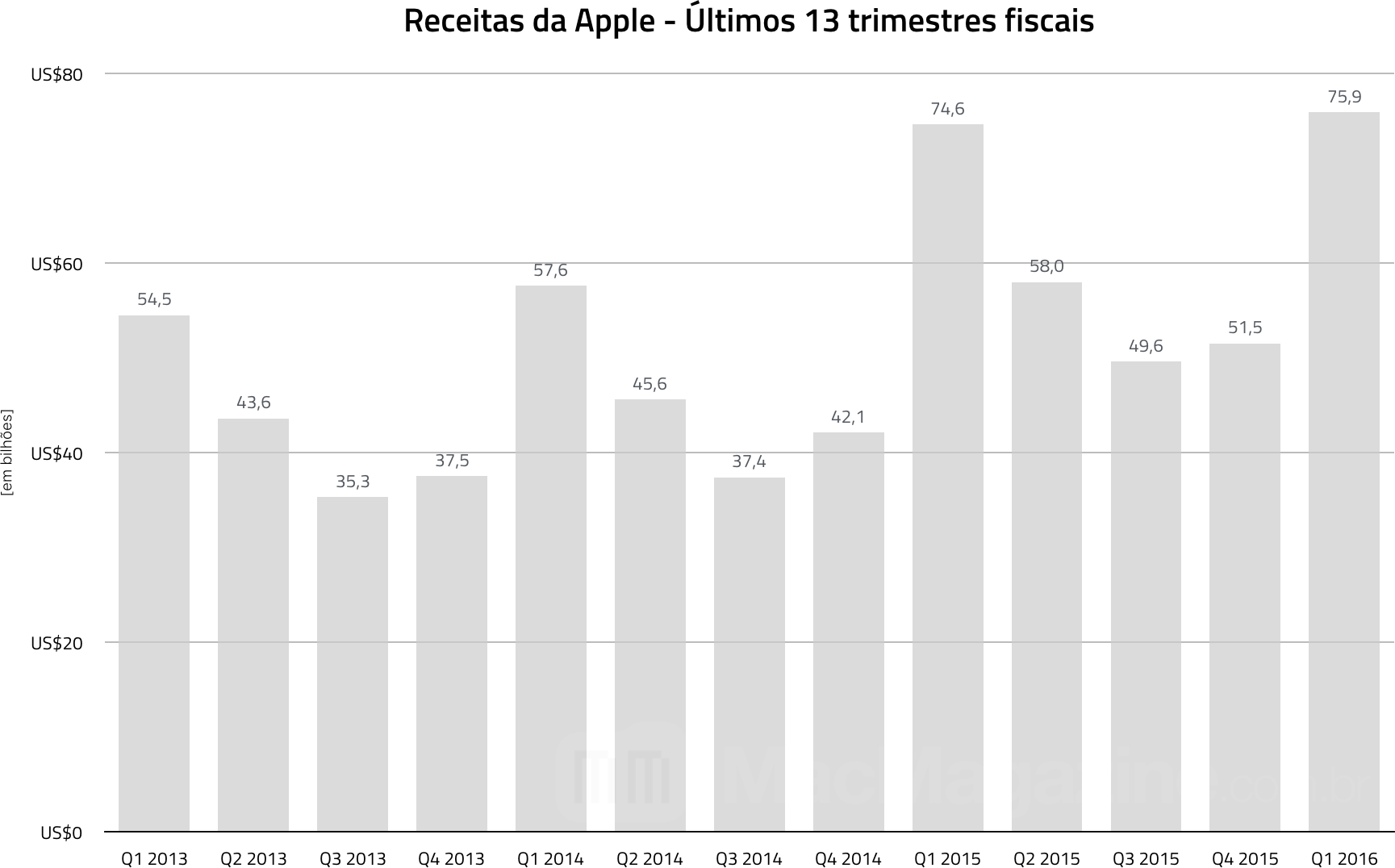

- This was the best fiscal quarter in Apple's history, with revenue 2% higher than in the same period last year.

- The appreciation of the dollar against other currencies makes it even more difficult for American companies to perform optimally, especially for those (like Apple) that now have a very large operation abroad.

- Apple now has about $ 216 billion in box.

- Of the authorized US $ 200 billion, the company has so far invested US $ 153 billion in the share buyback program.

- As we already said, Apple said that if it were not the “problem” of the dollar appreciation, this percentage of growth would be 8% (that is, $ 80.8 billion in revenue).

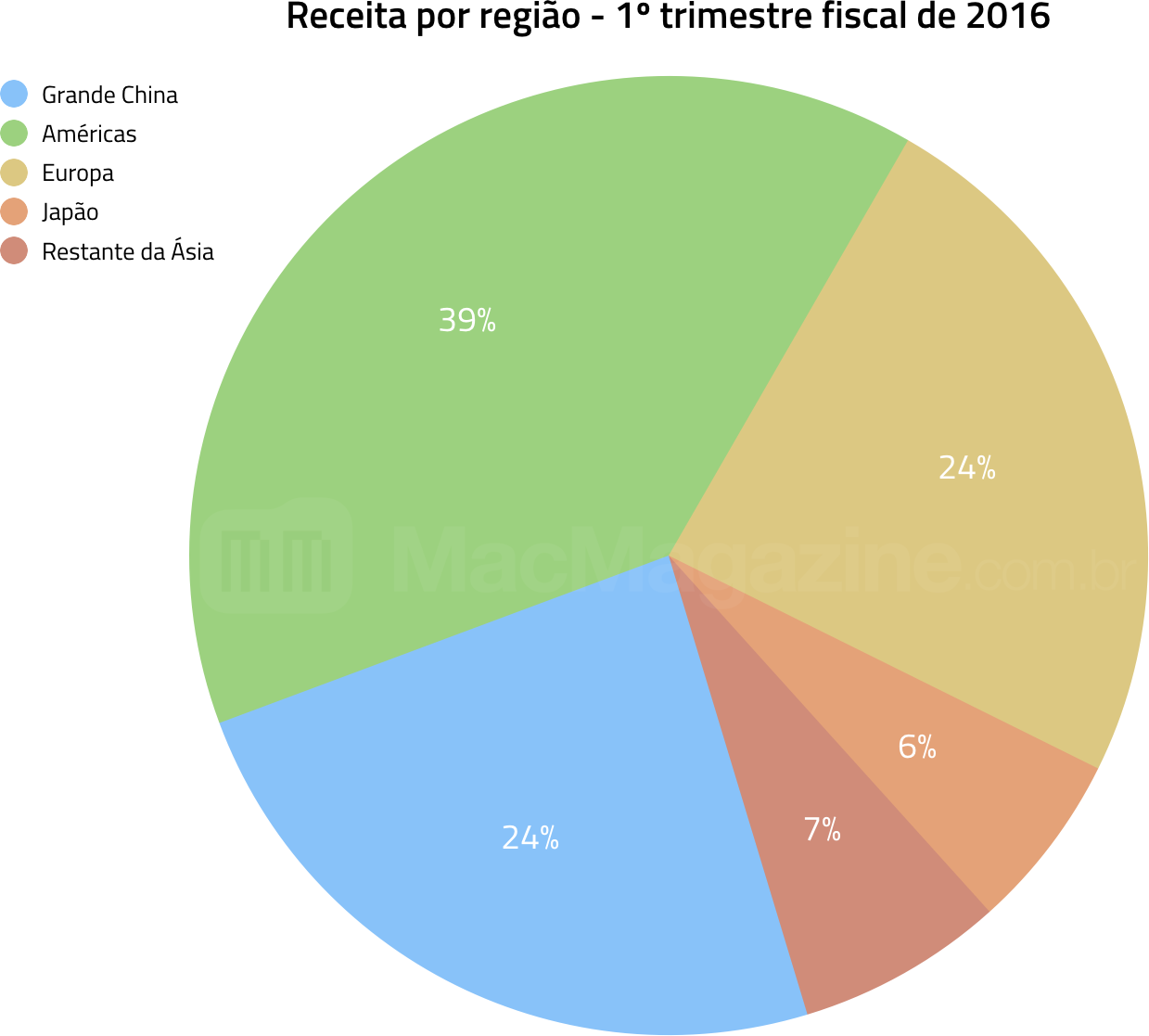

- Because of these conditions, Cook made it clear that it was a last quarter for Apple. Citing the complicated global scenario, he even used the Brazil and Russia as examples, saying that the local currencies of these countries depreciated 40% and 50% respectively. And since 66% of Apple's sales are now made outside the US, this has a major impact on the company's business.

- THE China, another concern for analysts, performed well (especially on iPhones, Macs and the App Store). Revenue closed the year 14% higher; sequential growth was 47% and, compared to the same period last year, 17% (taking into account a constant currency). Because of this, Apple is still very confident in China and will keep expanding plans in the country.

- The installed base of Apple users in the world now 1 billet (active devices, that is, that have connected with some service from the Apple App Store, iCloud, etc. in the last 90 days, which can be Macs, iPhones, iPads, etc.). This figure is 25% higher than a year ago.

iPhone

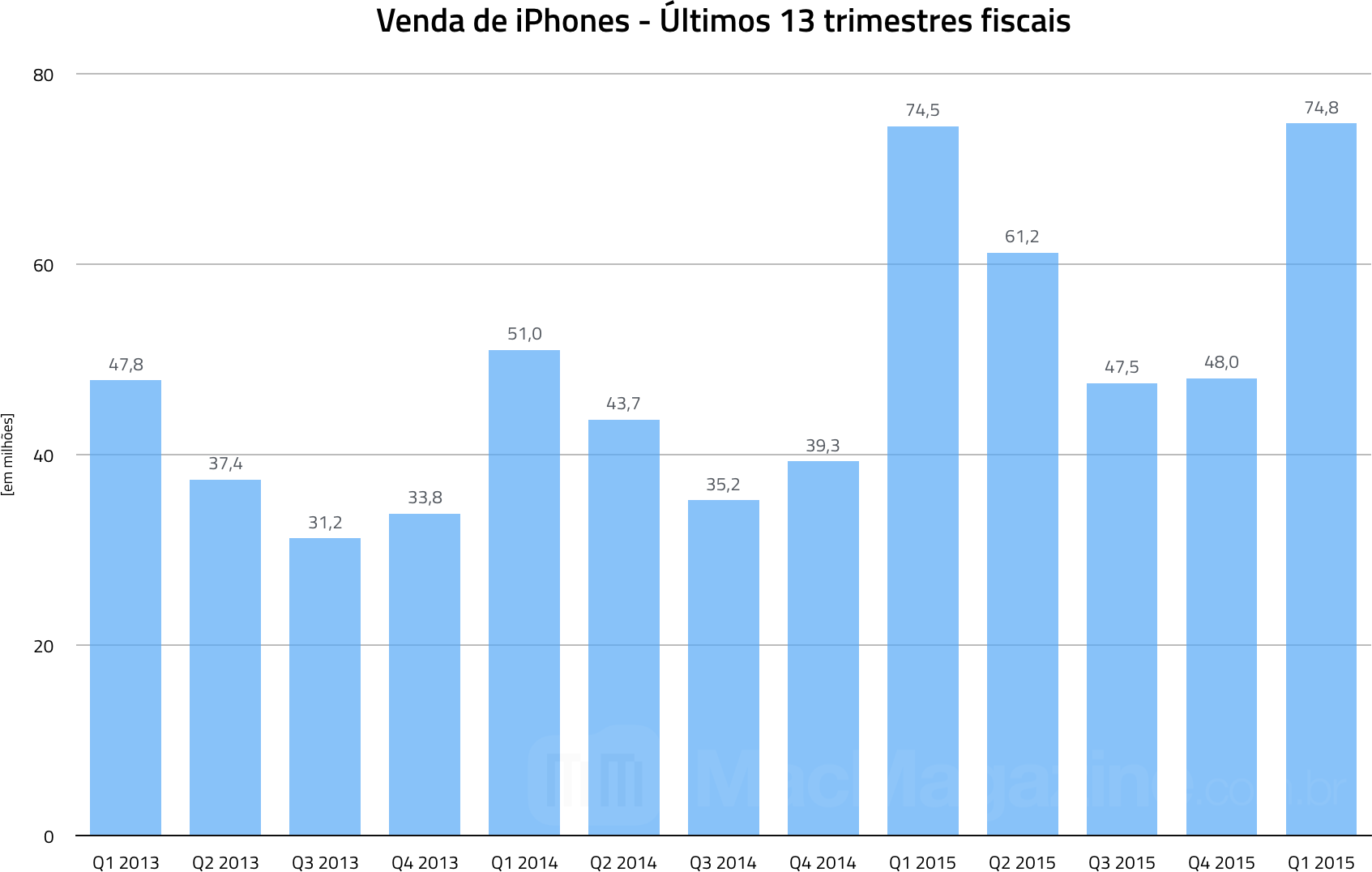

- Although iPhone sales have only grown 0.4%, the average price of each device broke a record, reaching $ 690.50. To give you an idea, the record had so far been set in the first fiscal quarter of 2009 ($ 674). In addition to now having more expensive devices (after all, the Plus entered the game raising the price of the device by US $ 100), the valued dollar also influences it a lot (according to Apple's accounts, US $ 49 of that value due to the impact of the dollar).

- Compared to the same period last year, growth was only 0.4% (300,000 units) as FQ1 2015 had an incredible performance. When comparing with FQ1 2014, however, we see a 50% growth in sales; if we compare it with the FQ1 of 2011, the sales volume was 4x higher.

- According to Cook, the migration rate of users of the Android for the iPhone hit a record in the quarter.

- Also according to the CEO, the user satisfaction rate for iPhones 6s / 6s Plus 99%.

- The loyalty / loyalty of users of iPhones is almost twice as high as the competitor that has the best rate.

- 60% the installed base of iPhone users has not yet migrated to devices with 4.7 and 5.5 inch screens.

- Cook highlighted the Apple ecosystem as a whole, where the user buys an iPhone, buys Apple apps and other services, then buys more Apple products because he likes the experience and, because of the value of the product, after some time he sells / donates the devices (they continue to be used by others) in order to purchase a new one. a very beneficial cycle for Apple.

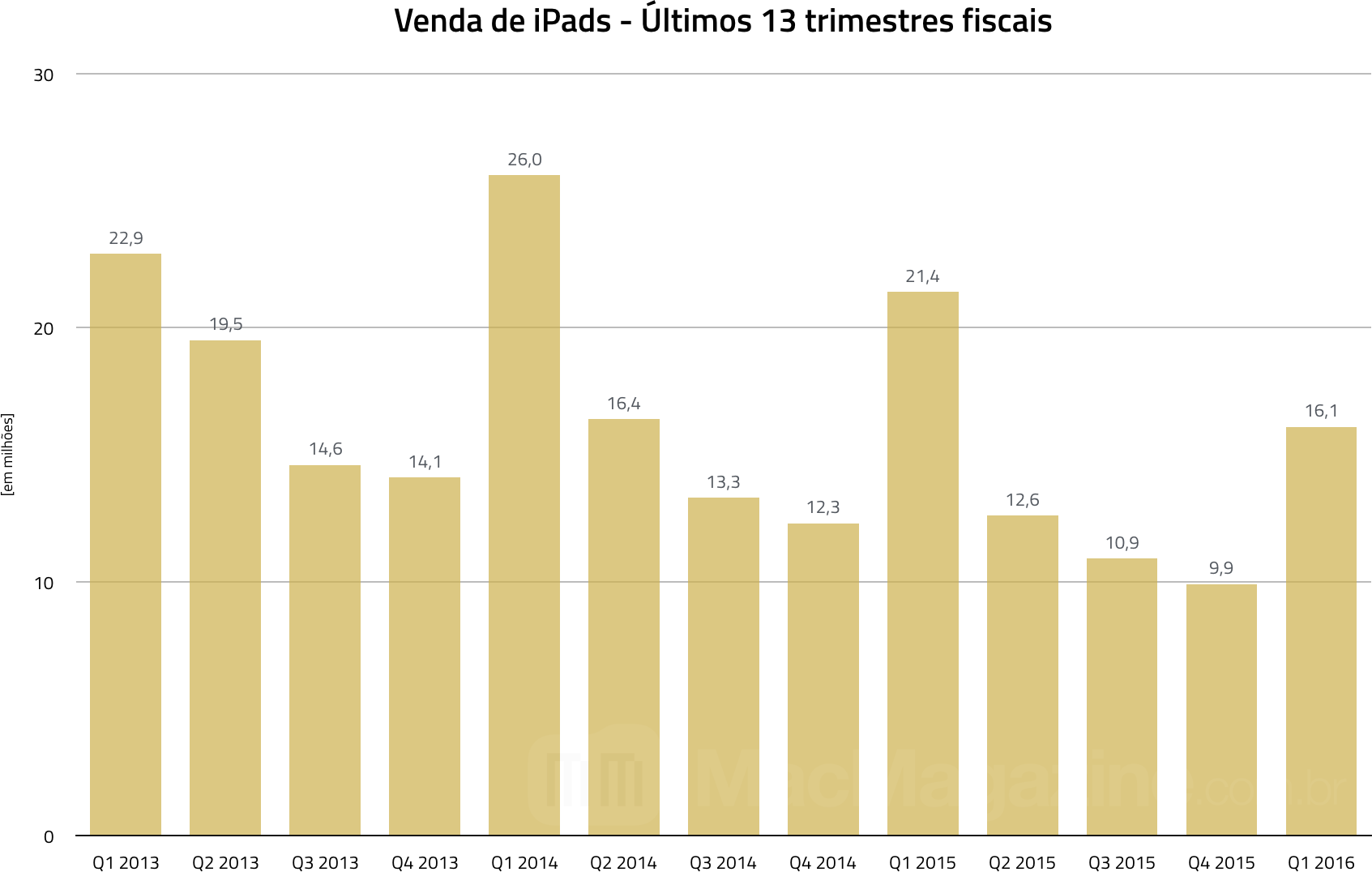

iPad

- IPad sales continue to fall; however, the arrival of the iPad Pro did not reflect sales in the quarter as it started to be sold towards the end of the fiscal period and still with very tight inventories.

- In the USA, the iPad represented 85% sales in the tablet market.

- The iPad Air 2 user satisfaction rate of 97%, Cook said.

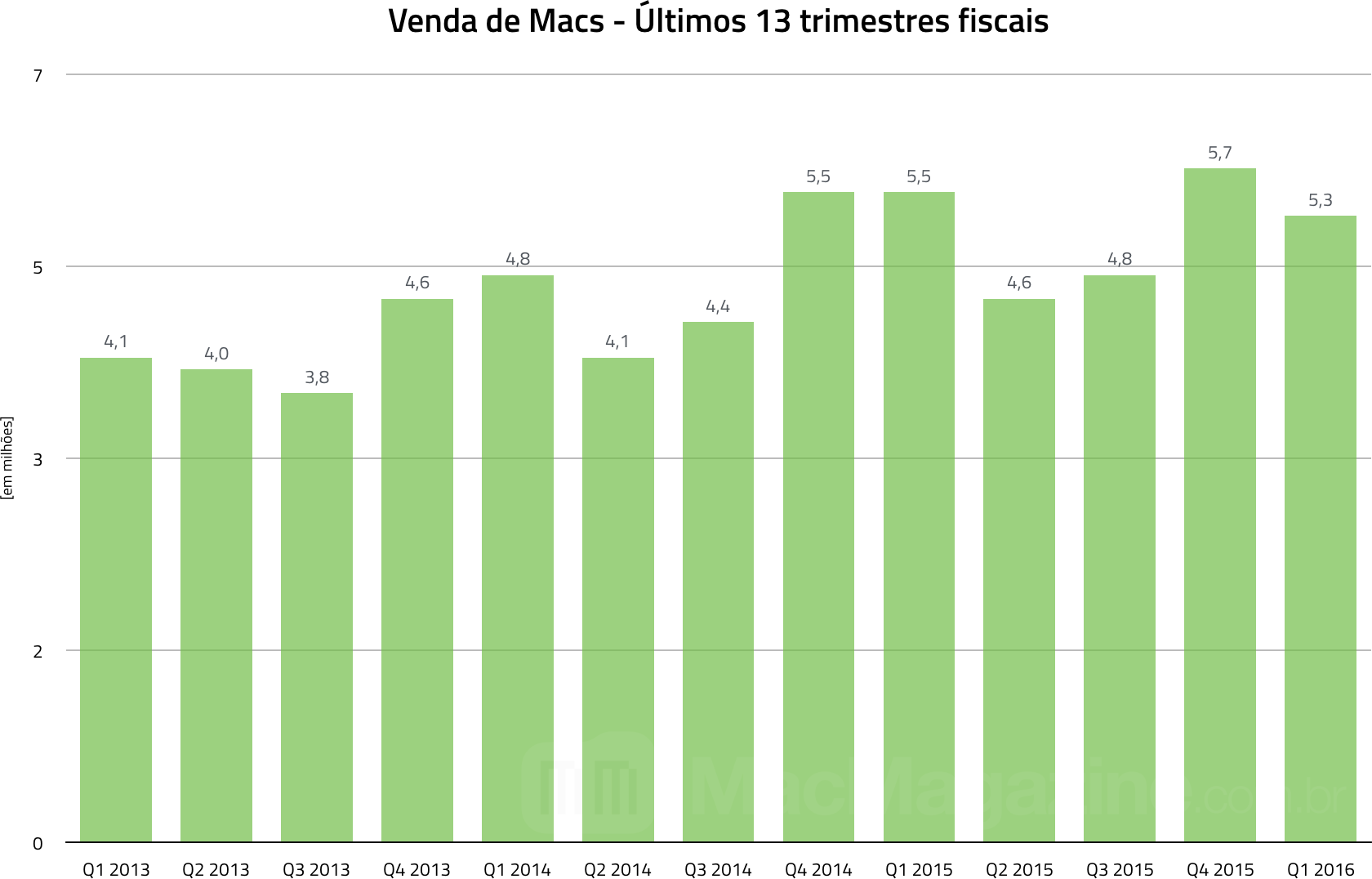

Mac

- This was the third strongest fiscal quarter on the Mac, with sales of 5.3 million of units. However, it was the second strongest in terms of billing, since the average price of each machine was at $ 1,270.

- Even with the fall, Apple continues to gain market share as other manufacturers are selling less and less.

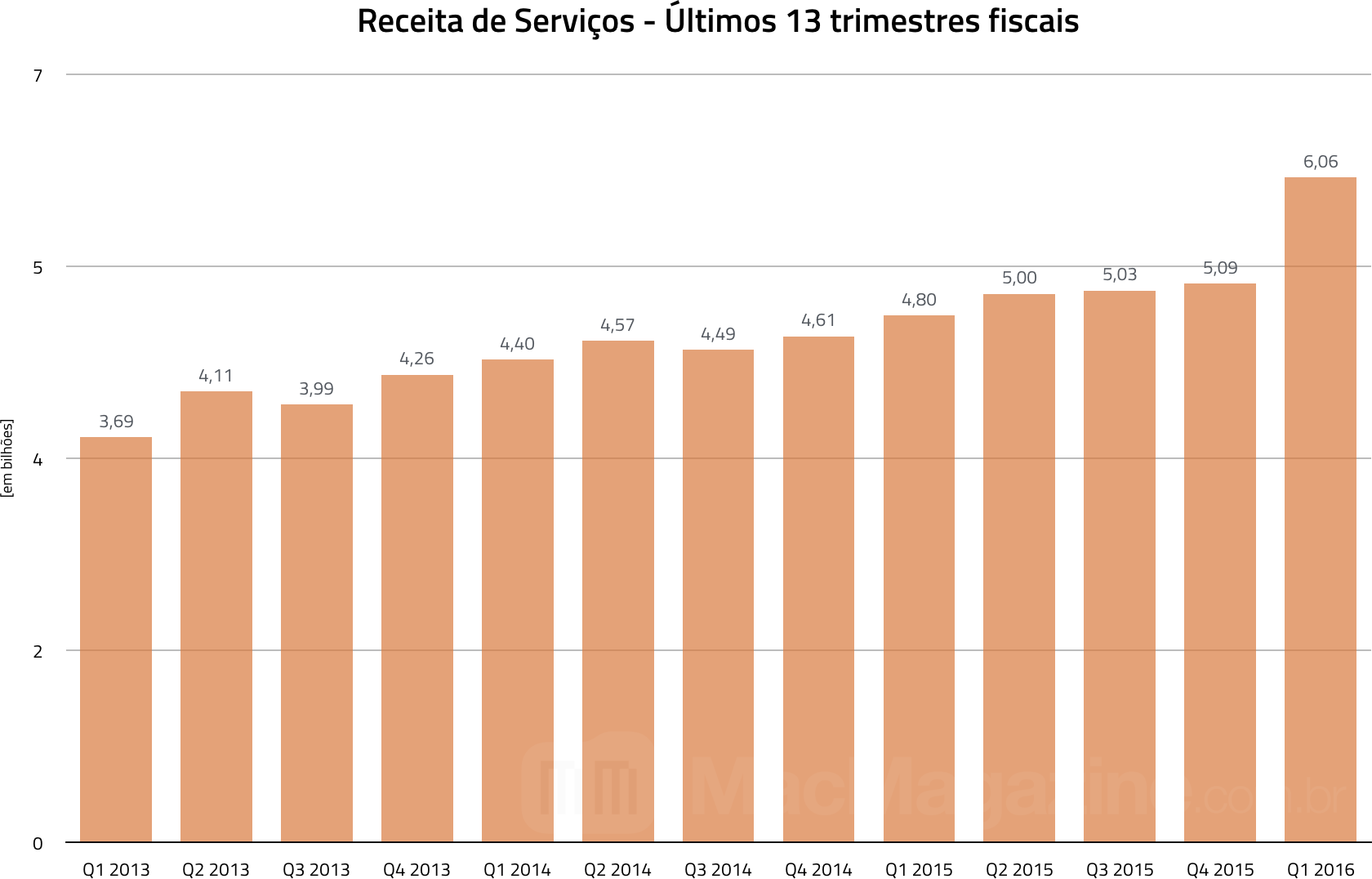

Services

"At $ 5.5 billion in quarterly revenue, Apples services business is roughly as big as Starbucks…" Not good enough! https://t.co/lKne0zCEri

– M.G. Siegler (@mgsiegler) January 27, 2016

With Earth's population saturated, Wall Street is disappointed that Apple hasn't been able to sell iPhones on a second planet yet

With $ 5.5 billion in quarterly revenue (excluding part of the dispute with Samsung), the business involving services from the company is almost as big as Starbucks ”is not good enough!

- Due to the installed base of 1 billion devices and growing at an accelerated pace, Apple's services are, of course, impacted (positively speaking).

Other products

- THE Apple TV had the best fiscal quarter in its history.

- The same thing happened with the Apple Watch December sales were very strong, according to Apple.

- Because of that, remember. In addition to Apple TVs and Apple Watches, Ma places products such as iPods, Beats headphones and other items in this segment. In total, they generated revenue from $ 4.3 billion, well above the $ 3 billion in the past fiscal quarter.

Forecasts

- Due to the global scenario (macro environment is weakening, all economies driven by commodities, Brazil, Russia, Canada, Australia), Apple is forecasting a decline for the next quarter of 5% The 10%.

- Responding to a question from an analyst who questioned whether sales of Apple iPhones in Apple's fiscal year 2016, the company reported that sales will fall in the next fiscal quarter, but that it does not project beyond the next quarter.

- Even though the scenario is bad, Apple does not intend to hit the brake. Even in markets where things are pretty bad today (like Brazil, Russia and some other oil-related economies), Apple believes this will pass. “These countries will be great places and we want to serve customers in them. Another country that will receive a lot of investment from Apple, in addition to China, is India. In addition, the company intends to continue investing heavily in research and development.

Other comments / curiosities

- During the conference, an analyst asked about Apple’s interest in virtual reality, if something that the company believes to be a niche or could become mainstream. The response was "encouraging", since Apple does not believe it is a niche and can have very interesting applications.

- Thanks to Samsung (yes, at the payment of $ 548 million), Apple managed to beat its profit record. If we take $ 548 million out of $ 18.4 billion, we get to $ 17.8 billion, less than the $ 18 billion in the first fiscal quarter of 2015. That money also helped raise the company's profit margin to 40.1% (above Apple's expectations). Who would say

· · ·

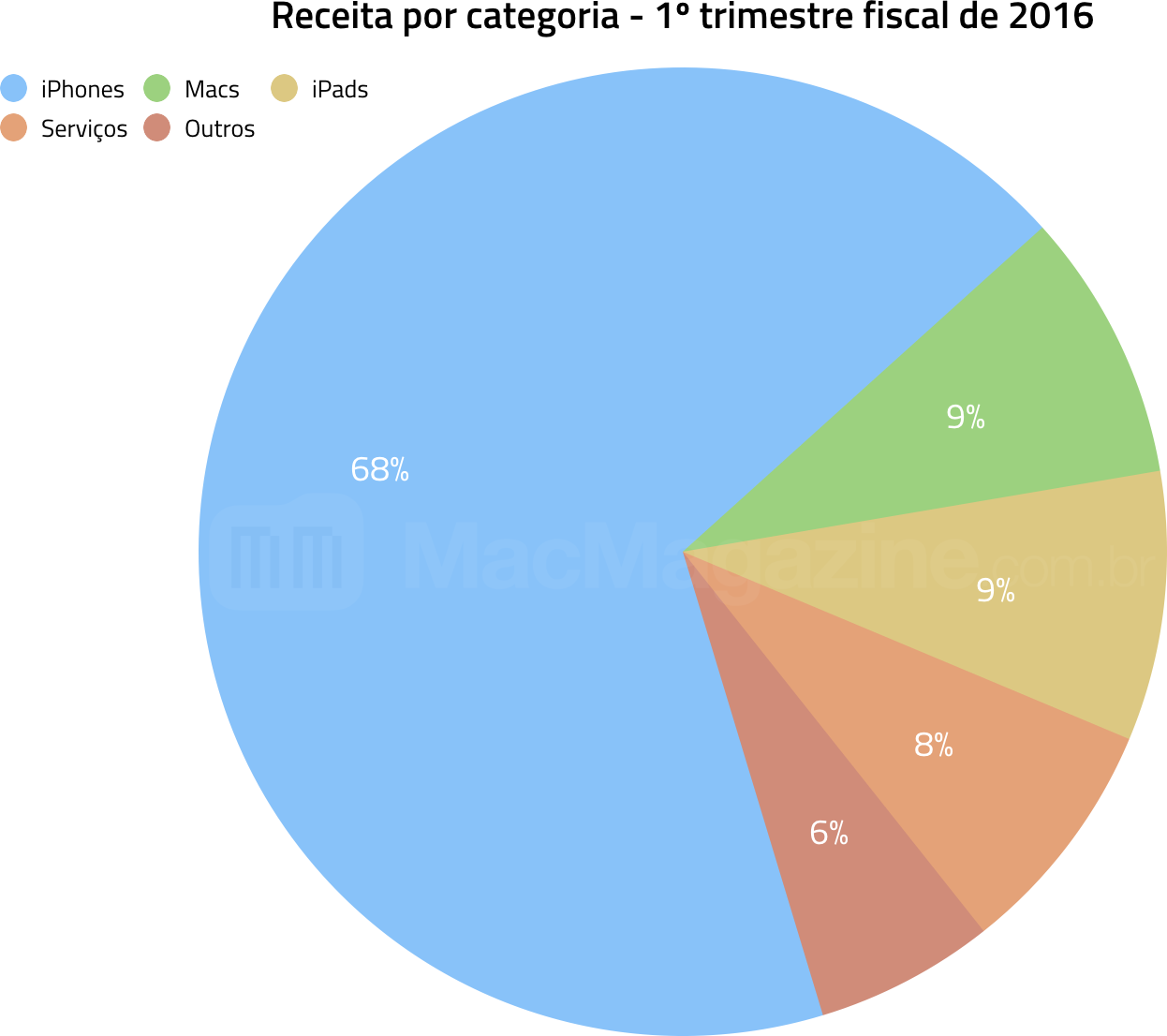

Below, some interesting graphs that summarize Apple's first fiscal quarter of 2016:

· · ·

· · ·

· · ·

· · ·

· · ·

· · ·

· · ·

(via MacRumors, AppleInsider, MacStories)