PC sales forecasts for the last quarter of 2009 had already been fine-tuned several times as consultants found that the market was reacting positively, but the final figures were still above what was anticipated. The figures released today by IDC and Gartnet continue to lag, but agree on this point.

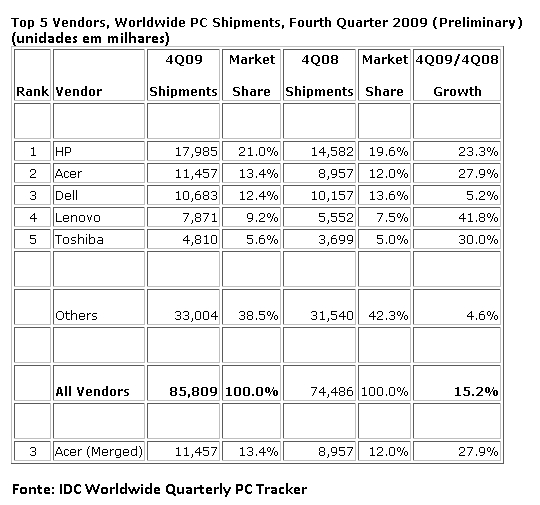

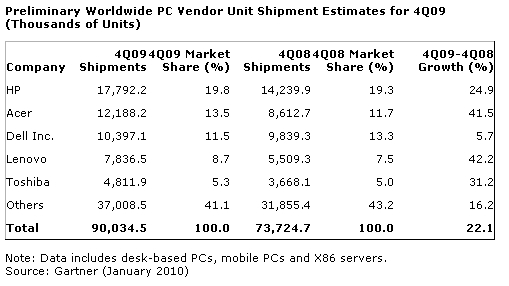

According to IDC data, sales grew 15.2% in the last three months, after the company set its forecast at 11%. Gartner’s figures are more optimistic and show a 22.1% increase in sales volume.

For IDC, this is the first quarter with double-digit growth after the third quarter of 2008, at a time when the PC market was affected by the economic crisis.

Gartner also has the same optimism, adding that this was the biggest quarterly growth in the PC market in the last seven years, although it should be noted that the comparison is benefiting from the weak sales quarter at the end of 2008.

Mikako Kitagawa, an analyst at Gartner, points out that these preliminary results indicate the recovery of the PC market globally, an opinion shared by Jay Chou of IDC, who guarantees that “the market has gone through a storm that seems to be behind”.

Notebooks, and especially low-priced laptops, continued to boost sales, whether on mini-notebooks (or netbooks) or on traditional lines. Consumer price sensitivity has intensified, as more and more users opt for “good enough” models.

The strong sales results in the United States are cited by IDC as one of the growth drivers. In that country, sales grew 24% compared to the previous year, as a result of price reduction initiatives with an unprecedented duration that led to sales of 20.7 million units.

The Asia-Pacific region returned to lead in growth rates, with a 31% increase in sales, while Europe, Middle East and Africa maintain more modest, although positive values, mainly guaranteed by the sales of low-cost mini-notebooks and notebooks.

In total, sales in the third quarter exceeded 85.8 million units, with HP maintaining the outstanding leadership, with a 21% share, followed by Acer (with 13.2%), which surpassed Dell (with 12.4 %). The fourth place belongs to Lenovo (with 9.2% market share) and the fifth to Toshiba (with 5.6%).

In Gartner’s assessment, sales amounted to 90 million units, but the distribution of seats at the top of sales is similar to that of IDC, with HP leading, followed by Acer, Dell, Lenovo and Toshiba.

Looking for balanceDespite the positive results, Jay Chou of IDC warns of the fact that these have also been sustained in reducing manufacturers’ margins, but that the medium-term assessment will force them to try to balance the maintenance of market share with profitability.

Differentiation between segments is also necessary. “Without an efficient strategy to transmit a clear usage model and a definition of features for each segment, the market will inevitably continue down the ramp to the” good enough “computer sold at the lowest price”, warns Jay Chou.