Next Bank is an online financial institution that offers clients facilities for opening an account and an international credit card. Through an Android and iPhone (iOS) app, users can create a service account from their mobile phone without having to submit data to a physical agency. With special college plans and fee exemption, Next sets itself apart from competitors such as Neon and Nubank in offering extra features such as managing an online kitty and automatic investment fund applications.

Created by Bradesco to compete with other digital institutions, Next also offers discounts on educational institutions, online stores, restaurants and tickets for cultural events. Check out the top questions and answers related to the benefits offered to customers with a digital account at Banco Next. The application can be downloaded for free from the dnetc Downloads page.

Function releases cardless withdrawal by smart; see how

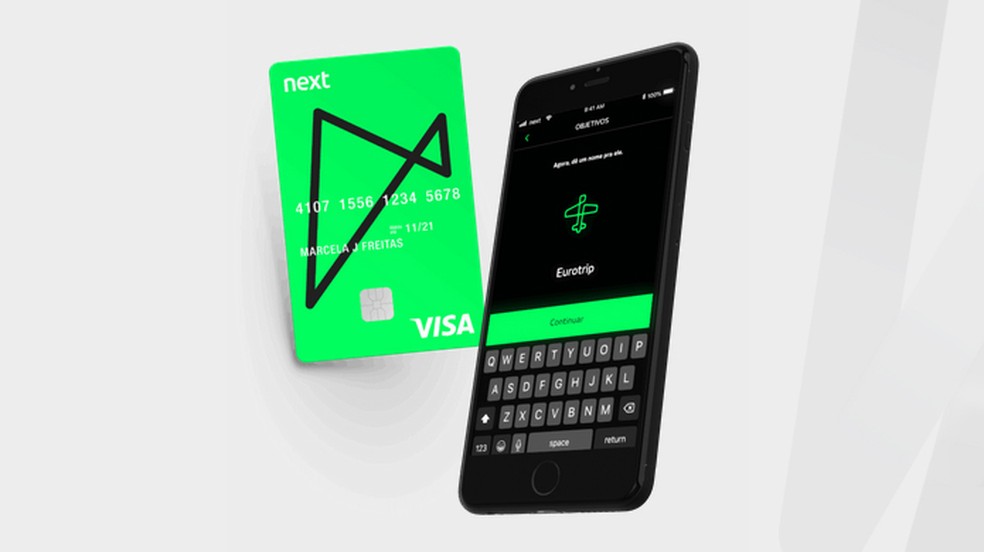

Next Bradesco's digital bank, created to compete with Nubank and other institutions Photo: Divulgao / Next

Want to buy a cell phone, TV and other discounted products? Meet the Compare dnetc

1. What and how does it work?

Like other digital banks, Next's main feature is the convenience of mobile account management. The platform is not linked to a physical bank and receives new customers through an app for Android and iPhone (iOS). New users register for the app and create their accounts on time, without the bureaucracy required by traditional institutions.

Next Bank does not have its own branches. However, clients can receive service at Bradesco branches and use bank tellers to withdraw money. Account holders also receive support for withdrawals from Banco24Horas network. Any questions or issues with your account should be resolved by expert support with in-app service.

One of the points in favor of digital banking is the ease of creating an account the procedure performed by the mobile phone. The interested user must install the Next application on the smartphone and inform the requested personal data. You will need to have your ID, driver's license and an updated proof of residence. During registration, you will need to take photos of the documents using the camera.

Next account opened by smartphone service app Photo: Divulgao / Next

As with the Bradesco application, users must monitor the status of the digital account to determine if the request for account creation has been approved. Upon confirmation, an international credit and debit card is sent to the registered address and the digital account can be accessed for transfers, payments and withdrawals.

4. What is the difference between Next, Nubank and other digital banks?

Next is a digital banking alternative that comes closest to traditional banks in its rates. Customers have some "basket" options that offer management, withdrawal and transfer actions. In the free plan, called "In the Strip", there are no fees to use and transfers are free between Next and Bradesco accounts.

Other "baskets" have unlimited resources such as transfers to any bank, Bradesco cash withdrawals and Banco24Horas network. Fare collection started after the five-month free period. In addition, clients of these plans receive pampering, travel assistance and receive points in the Livelo rewards program.

Next offers plans without fees and a special service modality for university students Photo: Divulgao / Next

Users of "In Range" and "In Measure" plans do not pay credit card dues. Already in the plans "It has Everything" and "Turbinado", the annuity charged. However, customers may receive discounts of up to 100% of the annuity amount. There is even a college plan that offers exemption from fees and an international card.

See the rate comparison between Next and other digital banks:

- Next: 2% fine on the outstanding + revolving balance (9.9 ms) + IOF;

- Inter Bank: fine of 2% on the outstanding + revolving balance (7.7% per month) + IOF;

- Neon: 2% fine on the outstanding + revolving balance (9.9% per month) + IOF;

- Nubank: 2% fine on the outstanding + revolving balance (2.75% to 14% per month) + IOF.

O dnetc prepared a list with some options of digital banks available in Brazil.

5. If the digital account does not charge fees, how does Next Bank make money?

Unlike some digital banks, Next offers "baskets" that cover withdrawal and transfer expenses. Compared to a regular bank, the company has no employee expenses and branch maintenance. The institution also profits from moving accounts and penalties for late payment of credit card bills.

Screen for tracking expenses on a digital account Next Photo: Divulgao / Next

Next also generates interest income on revolving credit and international withdrawals, where customers pay a fee of $ 20 and charges of 15.1%. The bank can also profit from offering personal loans at market-compatible interest rates.

6. What are the main features available in the account?

Among the benefits the company offers is a system called "Flow". The feature allows you to manage the budget of each user, separating expenses by categories. The system records movements and displays graphs that can help account holders better understand how their money is spent monthly. "Flow" even offers spending control tools that can help you save money.

Next offers exclusive discounts and cashback program to its customers Photo: Divulgao / Next

With the "Goals" function, users can set a goal for the bank system to set aside money in an investment fund. The customer sets the value and the app performs the applications monthly, automatically. The bank also offers discounts with partner companies, cashback, mobile recharge and an online kitty platform where customers can raise resources from friends.

How to put credit on mobile with free app