IDC today released new data on the personal computer market in the United States and around the world, bringing unsatisfactory numbers to the industry: with the race running for more sales, PC makers would be forgetting to offer good experiences to potential buyers . The result that many would be investing in iPa, tablets, or else simply avoiding a purchase, given the longevity of the hardware.

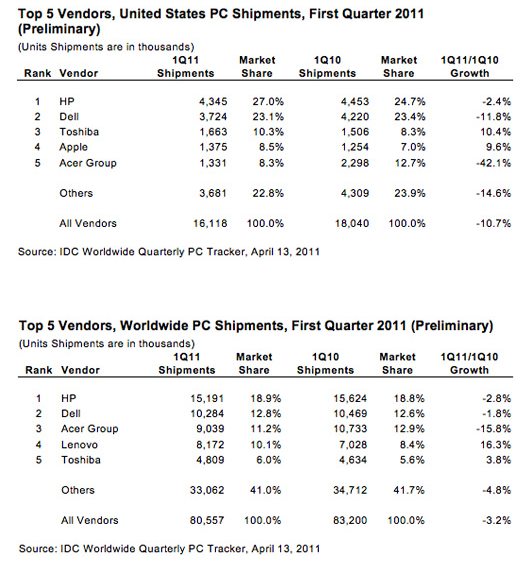

In the US, the market as a whole withered 10.7% and, of all computer manufacturers, only Apple and Toshiba had positive numbers. Ma grew 9.6% in relation to 2010, with 1.375 million Macs sold (8.5% of market share). Sabotaged by the iPad, Acer plummeted an astonishing 42.1%, leaving 8.3% of the market. The largest manufacturers remain HP and Dell, with 27% and 23.1% market share, respectively.

Globally, the top five in the market share ranking were HP (18.9%), Dell (12.8%), Acer (11.2%), Lenovo (10.1%) and Toshiba (6%). The market as a whole retracted 3.2%.

· · ·

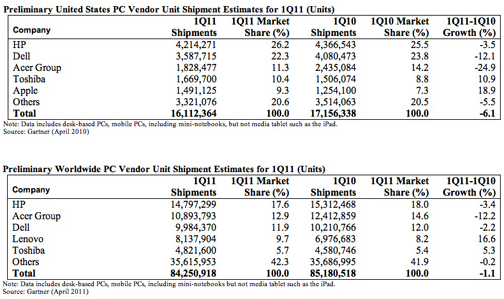

Gartner's estimates for the first quarter of 2011, in turn, were not much better for PCs. In the US, the computer market would have fallen 6.1% compared to 2010, driven mainly by Dell's declines (12, 1%) and Acer (24.9%). In the contract, Apple and Toshiba had growth of 18.9% and 10.9%, respectively. In terms of market share, Ma was in the fifth position, with 9.3% (1.49 million Macs).

Worldwide, the computer industry would have dropped to a mere 1.1%, with the share ranking distributed as follows: HP (17.6%), Acer (12.9%), Dell (11.9%), Lenovo (9.7%) and Toshiba (5.7%). The company with the highest growth would have been Lenovo (16.6%), due to its success in China; beyond that, in this list only Toshiba would have grown annually (5.3%). All the others had declines, the worst being Acer, 12.2%.

This would be explained, once again, by the existence of the iPad: with the price rush of PC manufacturers, less and less traditional computers would have attractions. Thus, consumers would be turning to tablets. This would also explain Acer's poor performance, as its excessive dependence on netbooks would now backfire so much that it even brought down the company's CEO.

(via Electronist: 1, 2)