The Federal Government website provides an application simulator at Tesouro Direto, which helps novice investors to choose the best security to invest. a type of fixed income investment, that is, the final profit of the investor determined from the moment of purchase, either by a fixed amount or based on some index (such as the Consumer Price Index, the IPCA). Therefore, since there will be no loss of money, it is considered to be of low risk and very chosen by those who are starting to invest.

Tesouro Direto is a program of the Federal Government for the purchase and sale of public bonds for individuals that aims to obtain resources to finance public debt. When buying these bonds, the person is "lending" money to the Brazilian government. In return, receive, in the future, the amount applied plus interest. Here's how to simulate the investment.

READ: How to find out the PIS / PASEP number on the Internet

Tutorial teaches how to simulate application in Tesouro Direto by government website Photo: Divulgao / Tesouro Direto

Want to buy cell phones, TV and other discounted products? Meet Compare dnetc

Step 1. Access the National Treasury website (tesouro.fazenda.gov.br) and select the option "Tesouro Direto", in the quick access area;

The Federal Government provides an application simulator at Tesouro Direto Photo: Reproduction / Clara Barreto

Step 2. Check "First time at Tesouro Direto? Start here";

The Tesouro Direto website has various information on possible investments Photo: Reproduction / Clara Barreto

Step 3. Choose the option "Financial simulator";

The financial simulator makes available the current securities and what income a potential investor will have at maturity Photo: Reproduo / Clara Barreto

Step 4. Select the option "I want to simulate an application" in the bottom bar of the window;

To use the simulator simply access the link inside the Tesouro Direto website Photo: Reproduo / Clara Barreto

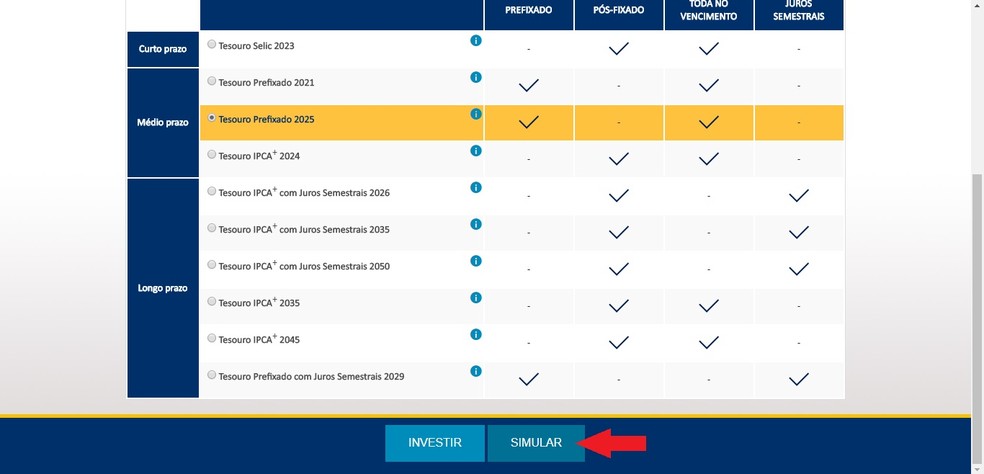

Step 5. The list of available securities to invest in a table appears, indicating whether they are pre-fixed or post-fixed and whether they will be received only at maturity or through semiannual interest. Choose the option that best suits you;

The securities available in the simulator are the same as those available for immediate investment Photo: Reproduction / Clara Barreto

Step 6. Check "Simulate" at the end of the page;

After choosing the title it is possible to simulate your investment Photo: Reproduction / Clara Barreto

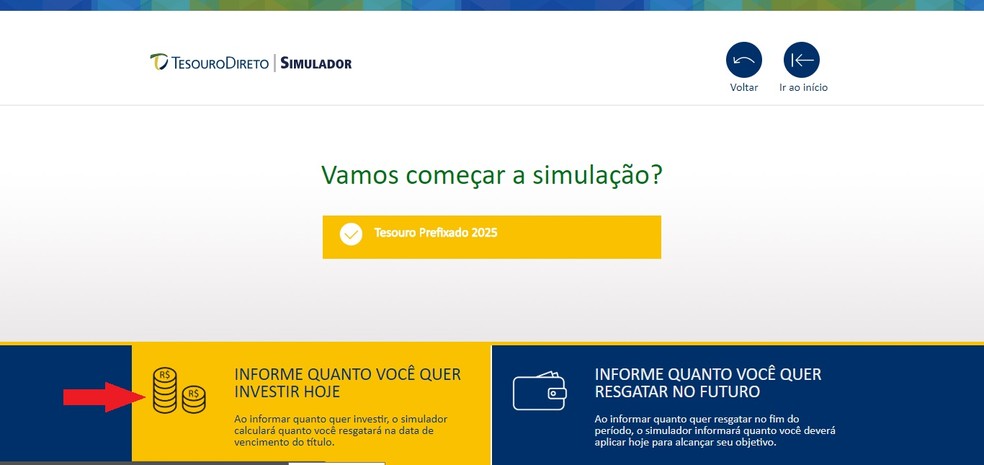

Step 7. Right now you have two options: say how much you want to invest or how much you want to redeem in the maturity year. In this case, we will put how much we will invest;

There are two ways to simulate an application: saying how much you want to invest or how much you want to receive Photo: Reproduo / Clara Barreto

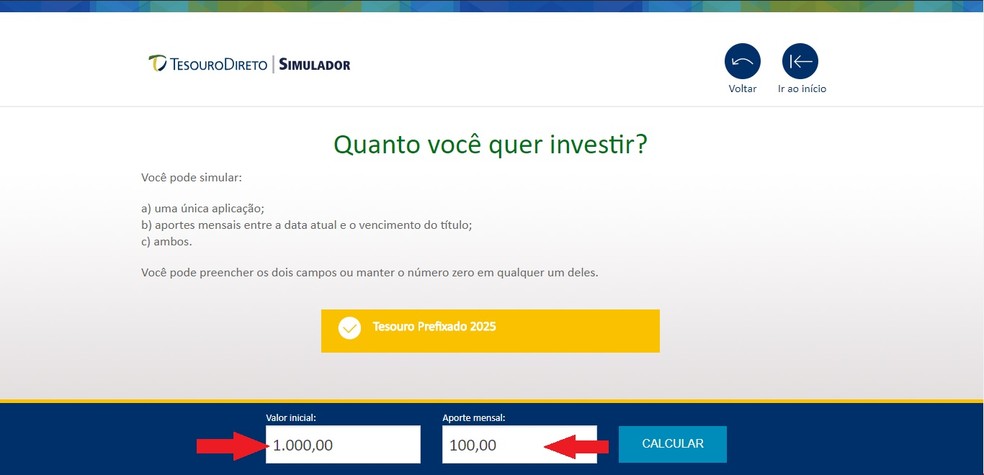

Step 8. The investment can be made with a single application or a monthly application until the maturity date. In the case of a single application, just fill in the first part; in case of a monthly application, just fill in the two gaps. Then select "Calculate";

The investment can be made from a single application, monthly contributions or both Photo: Reproduo / Clara Barreto

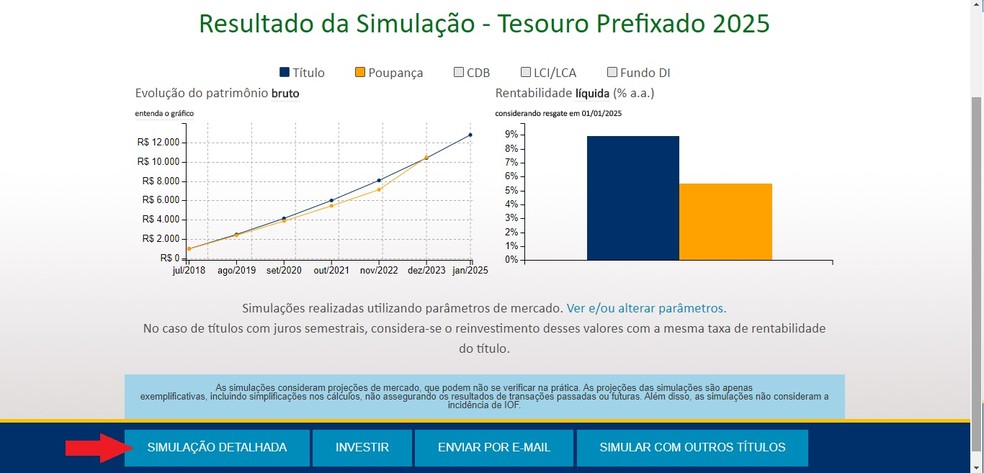

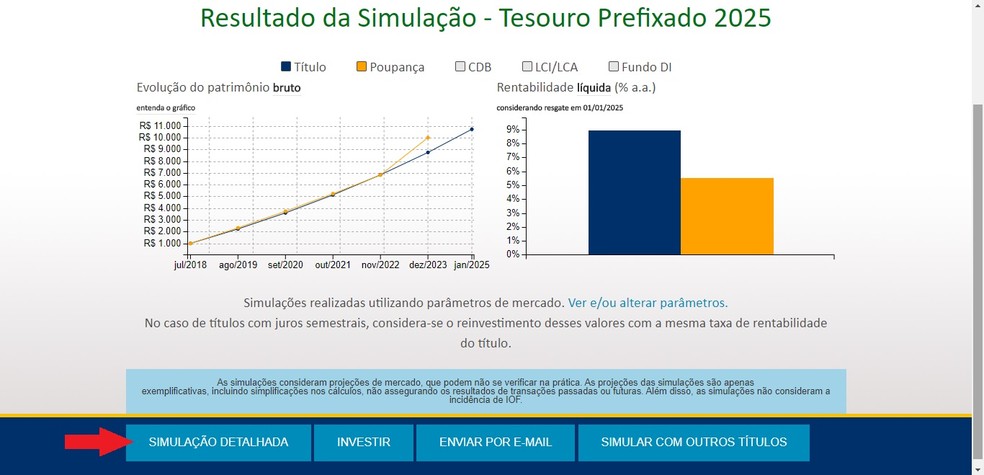

Step 9. The initial result of the simulation appears in graphs: the first showing how much money you will receive until the year the title expires, and the second comparing if you made the same application at a savings. For more details, select "Detailed simulation";

The result appears immediately afterwards, comparing with the same application in a saving Photo: Reproduction / Clara Barreto

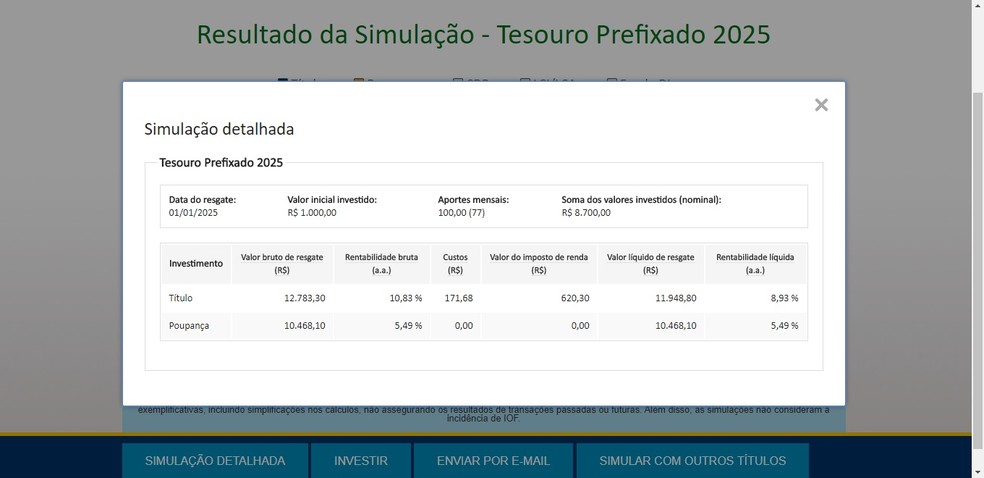

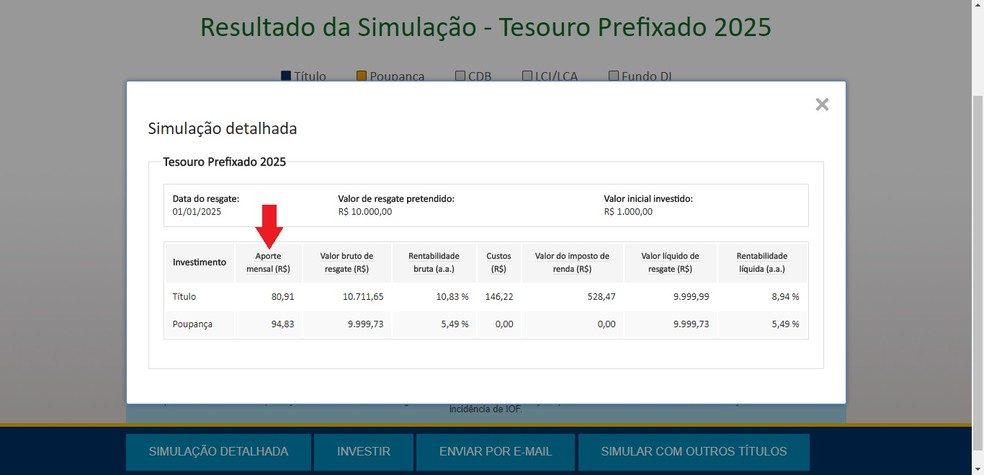

Step 10. In the detailed simulation, in addition to the amounts invested, redeemed and the comparison with savings, there will also be information on administration costs and how much the income tax is levied on income, giving, in the end, the net total you to receive.

The detailed simulation also shows the investment costs, showing gross and net receipts Photo: Reproduo / Clara Barreto

Simulating how much you want to earn

Step 1. If you want to simulate how much you intend to redeem at maturity, in step 7 select the option "Inform how much you want to redeem in the future";

The second type of simulation for how much you want to redeem on expiry Photo: Reproduo / Clara Barreto

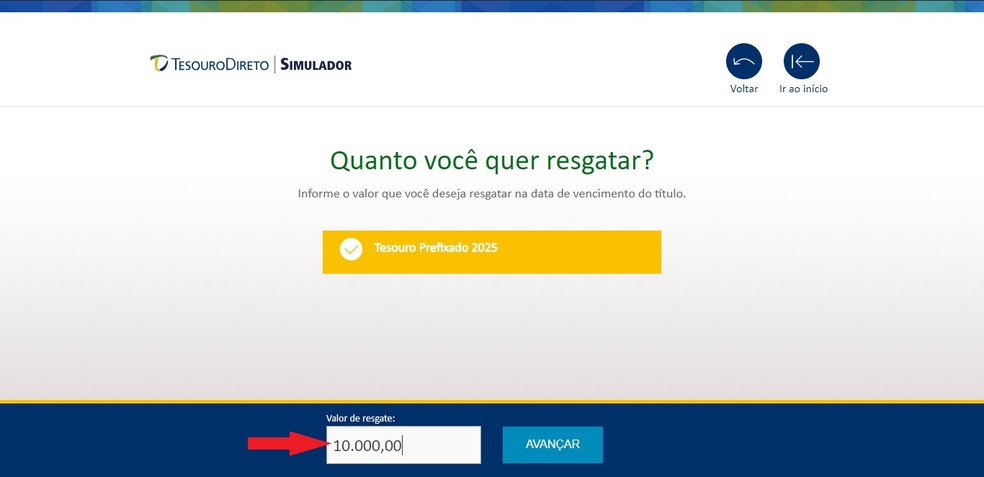

Step 2. Enter the amount you want to receive and select "Next";

To simulate your rescue, just include the amount you want Photo: Reproduo / Clara Barreto

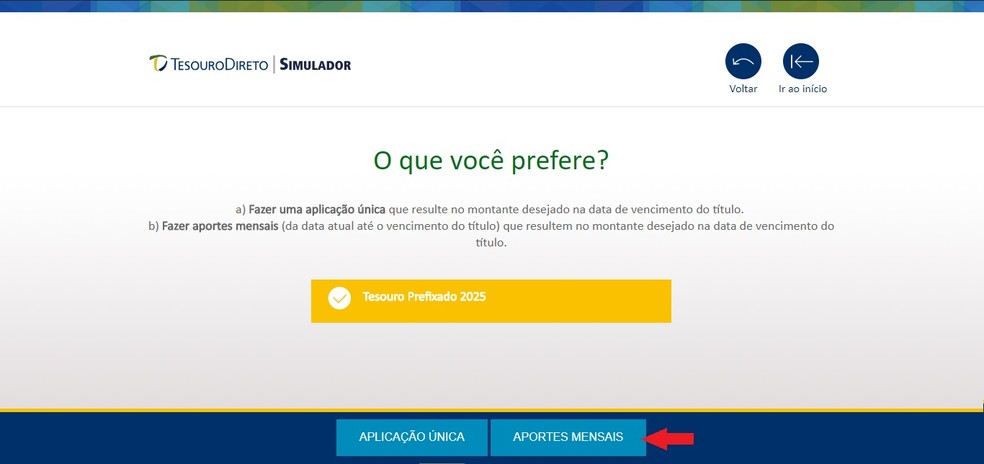

Step 3. Choose if you want to make a single application or monthly contributions (deposits every month);

Even in this case, it is possible to simulate a single application or monthly contributions Photo: Reproduction / Clara Barreto

Step 4. If you want to make a single application, the result will come out right away. If you chose monthly contributions, fill in the initial amount (your first deposit) and select "Calculate";

Even applying monthly, it is necessary to say how much you intend to apply the first time Photo: Reproduo / Clara Barreto

Step 5. To have the information more clearly, press "Detailed simulation";

The result is also shown in graphs Photo: Reproduction / Clara Barreto

Step 6. Finally, how much you should pay monthly appears in the second column.

The detailed simulation shows how much it will be necessary to invest monthly if the first application is the amount inserted in the simulation Photo: Reproduction / Clara Barreto