Nubank integrates with the positive record of Boa Vista. It is a register with information provided by financial institutions that reveal whether the user usually pays his bills on time and if he has debts in the square. By activating the feature, Nubank gains access to your score and that information can be used to increase the limit on your credit card.

In the following tutorial, see how to activate your positive Nubank registration. The procedure was performed on an iPhone (iOS), but the tips apply to Android users. Check, at the end of the article, the main doubts on the topic, answered by the Nubank communication team.

Learn how to activate positive registration on Nubank Photo: Felipe Vinha / dnetc

How to pay Nubank with NuConta and release the card limit quickly

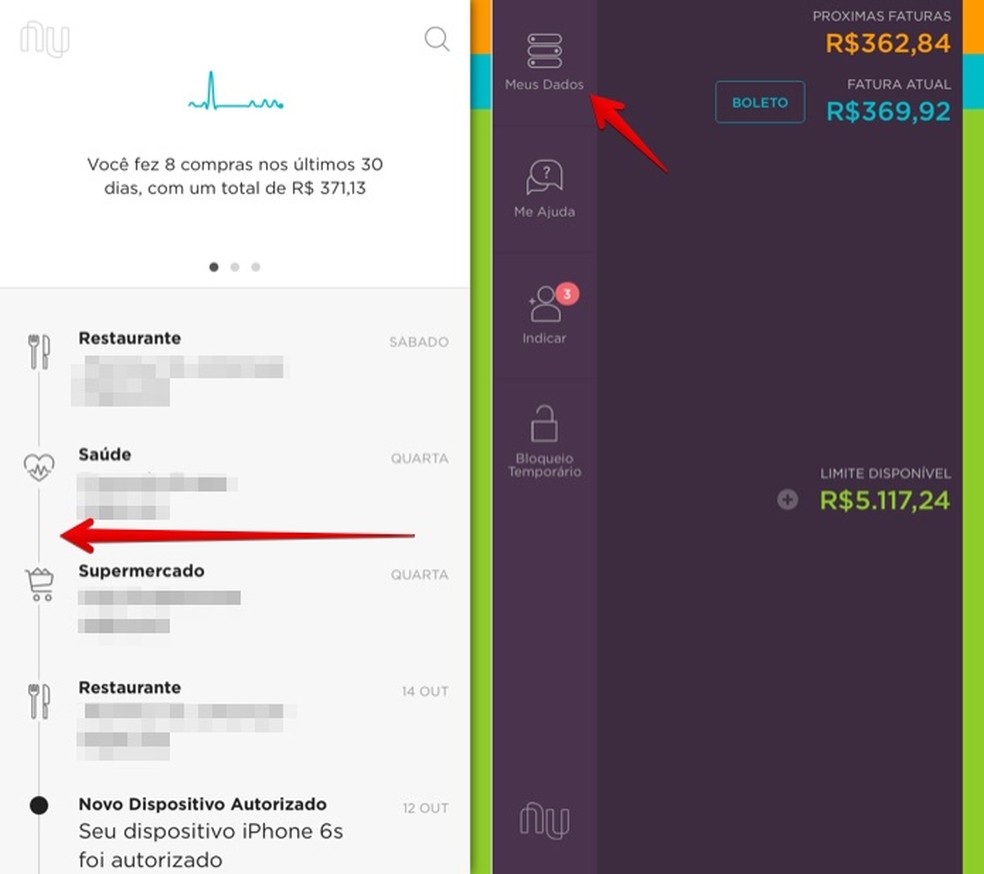

Step 1. Open the Nubank app and slide the screen to the left. Then tap on "My Data".

Access the Nubank settings Photo: Reproduo / Helito Bijora

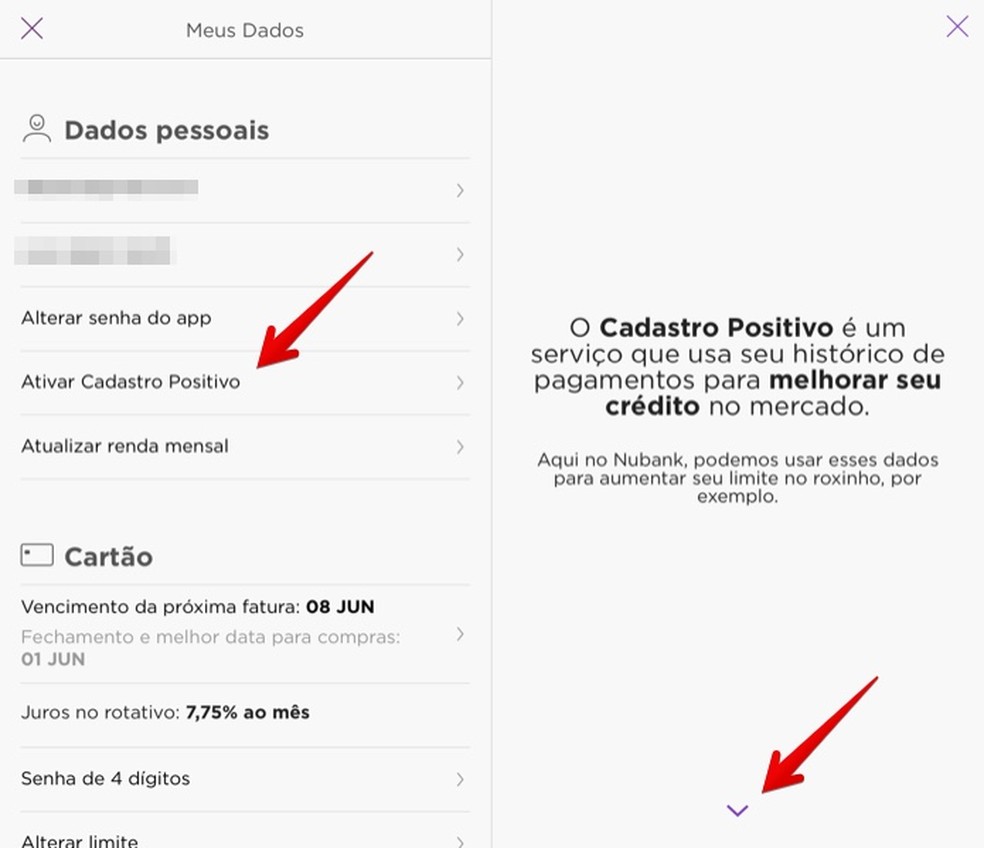

Step 2. In the "Personal data" section, tap "Activate Positive Registration". Then, touch the arrow at the bottom of the screen.

Activating positive registration on Nubank Photo: Reproduo / Helito Bijora

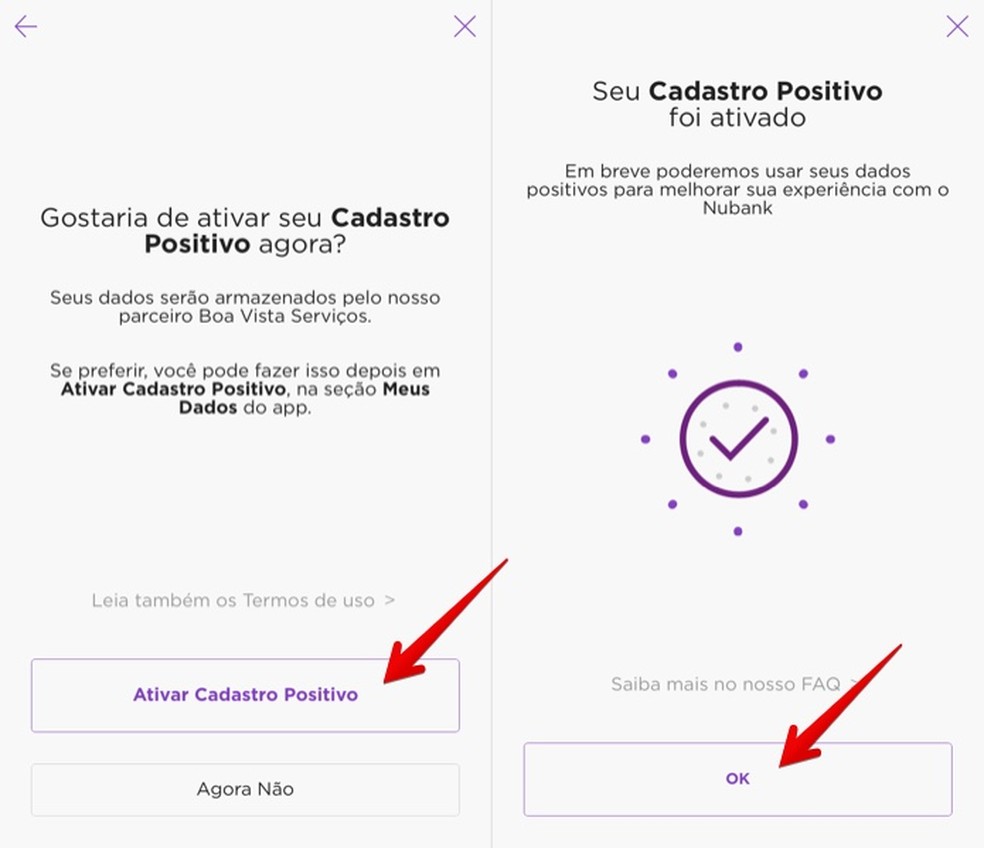

Step 3. Touch "Activate Positive Registration" and finally touch "OK".

Activating positive registration on Nubank Photo: Reproduo / Helito Bijora

We spoke with a public relations officer at Nubank about the procedure for enabling positive registration. Follow, below, the main doubts and the answers provided by fintech.

How can the credit limit go up if the user activates the positive registration?

For some people who request our card, the only credit information available is that contained in the negative credit records. While the big banks have much more information about people, Nubank has limited information for making credit decisions. The positive registration helps to have a more complete view of people's credit when considering the times that each person paid their bills on time instead of focusing only on those times when they were not paid or were paid late. We believe that of the 12 million people for whom we had to deny the card, because of their credit situation, we could certainly have approved more of them if we had positive registration information.

Is there a possibility that the limit will drop when activating the positive registration?

Nubank did not answer this question directly. In a note, the company said that the priority is to speed up the waiting list, obtaining more information to help in making decisions about releasing or not a card for the thousands of people who come to us. It also says that we have an average of 500 thousand people on that list precisely because, at the moment, we understand that we do not have enough information to say yes or no, but that this scenario may change in the short term.

A survey by Serasa, published by the newspaper Folha de So Paulo in February, showed that 22% of the followers of the positive registry saw the score fall. The news was passed on by the Economic Value.

The optional positive registration?

The law says that this registration opt-in, which means that you only enter it if you give your permission. That is why we created a flow within our application, together with our bi partner that allows people to give authorization to participate in the registration if they wish.

The process to deactivate positive registration requires contacting Boa Vista Servios through the online portal, through the service stations or through the correspondence center.