Apple yesterday released the financial results for its fiscal third quarter 2016 and, although we saw a drop in sales of several products, the numbers were exactly within the company's forecasts up to just above what analysts expected.

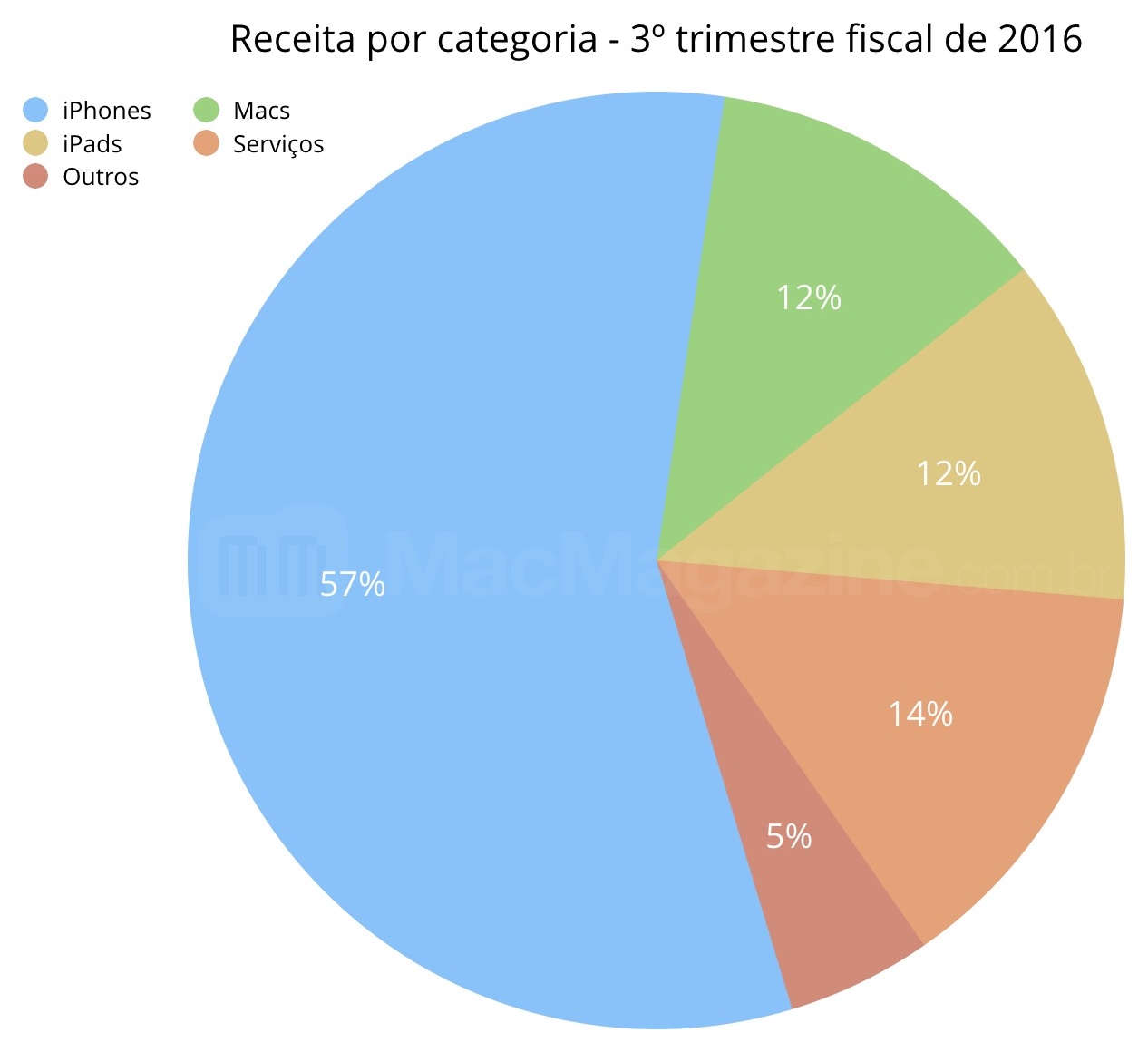

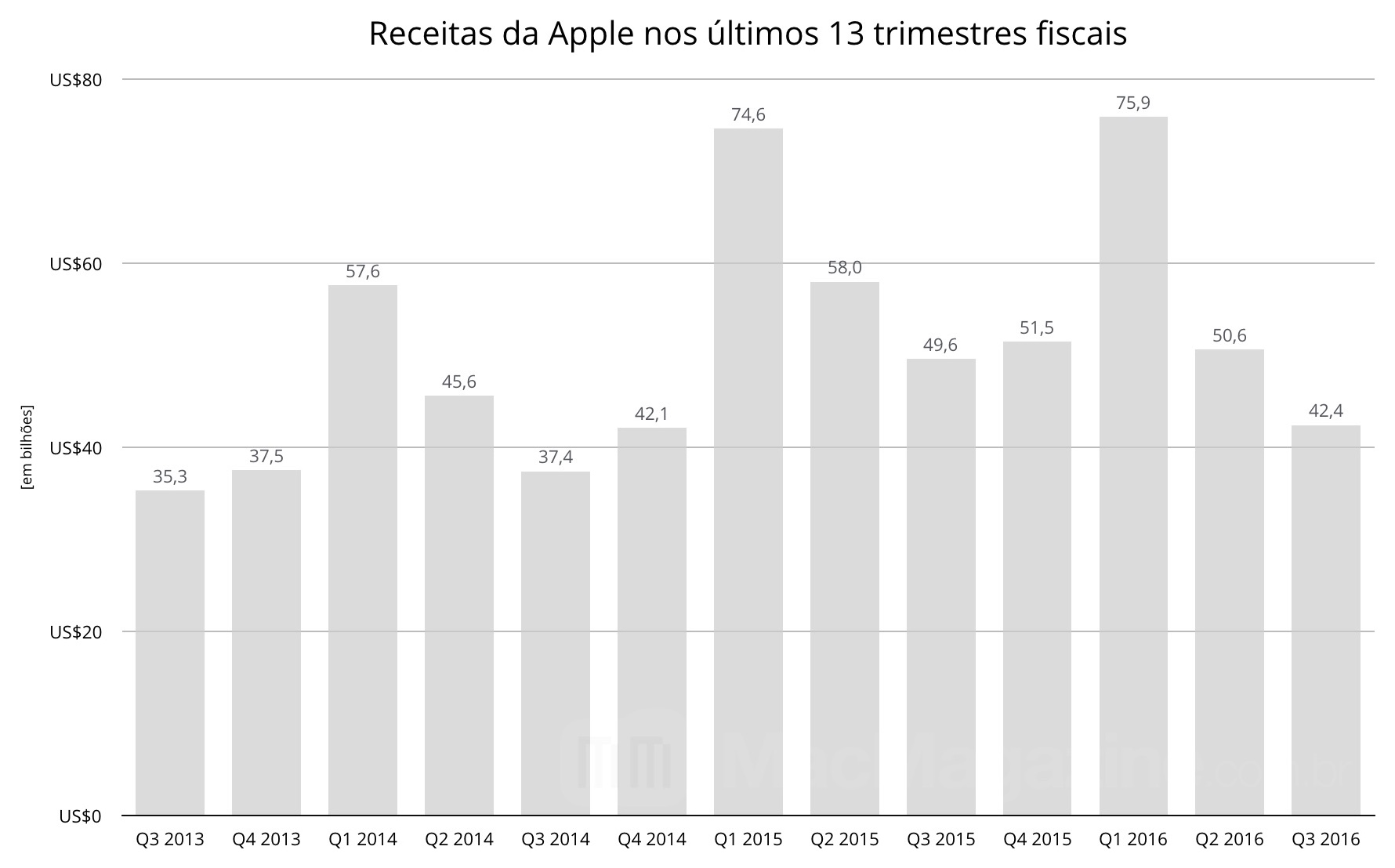

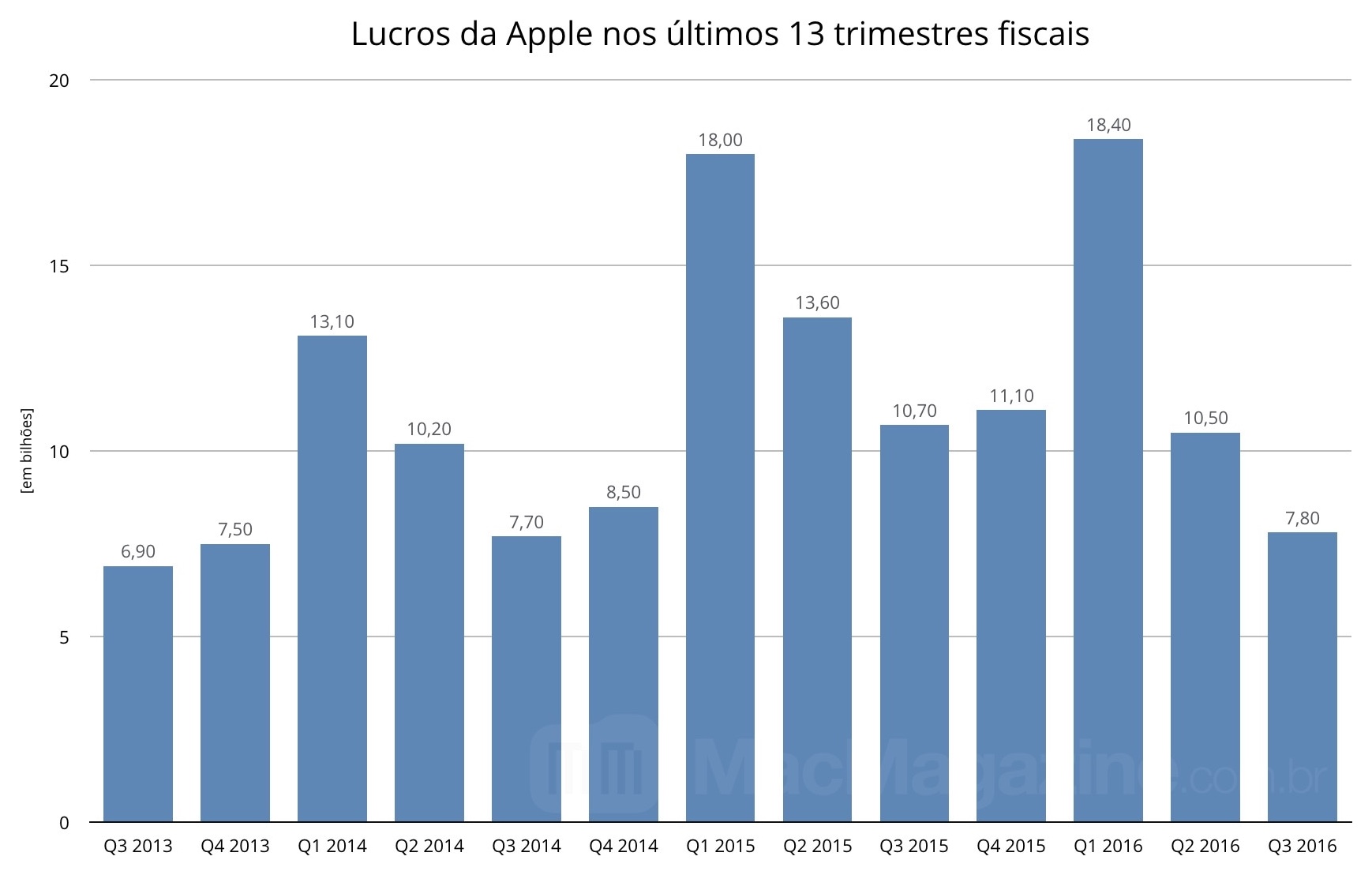

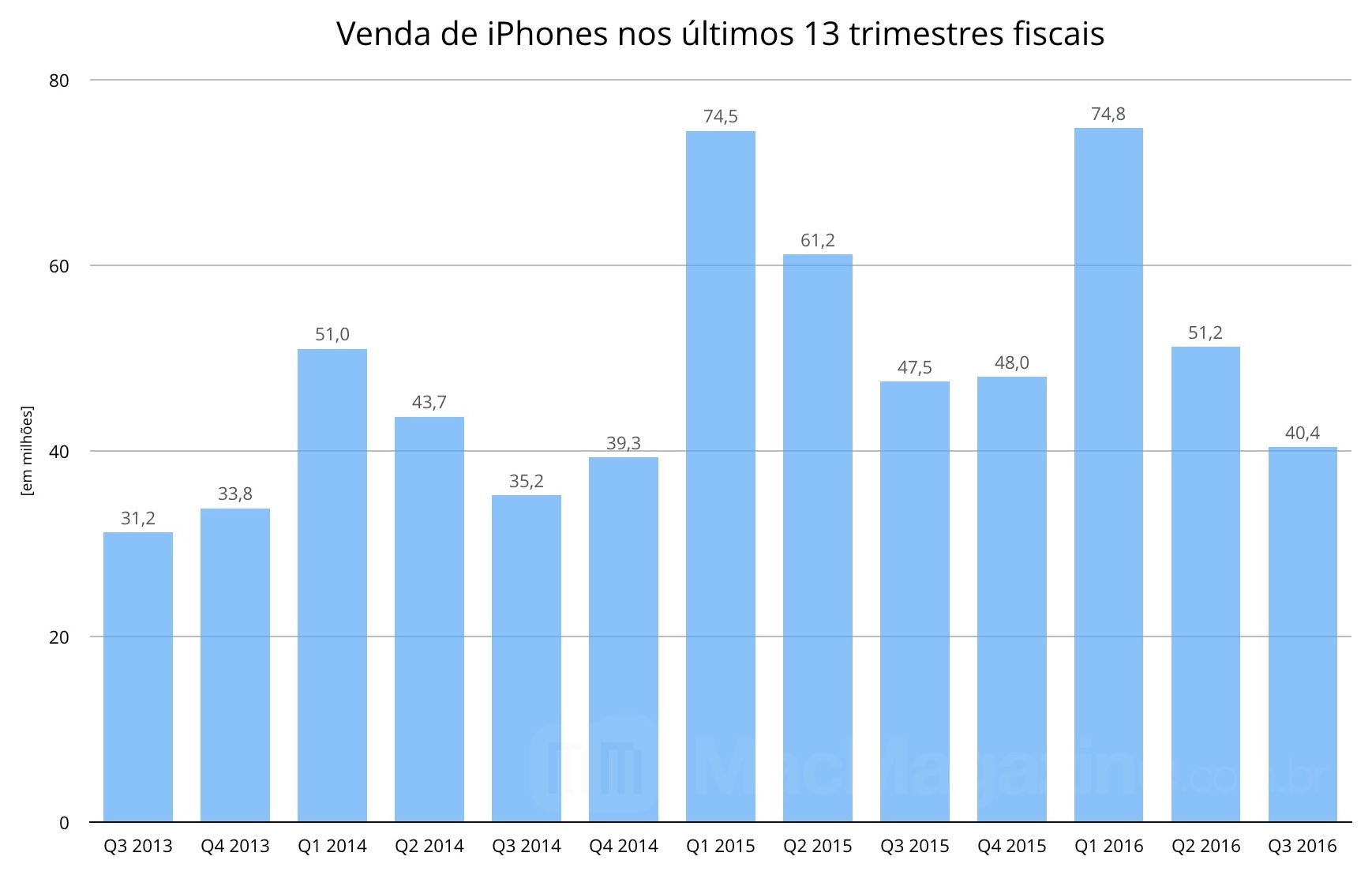

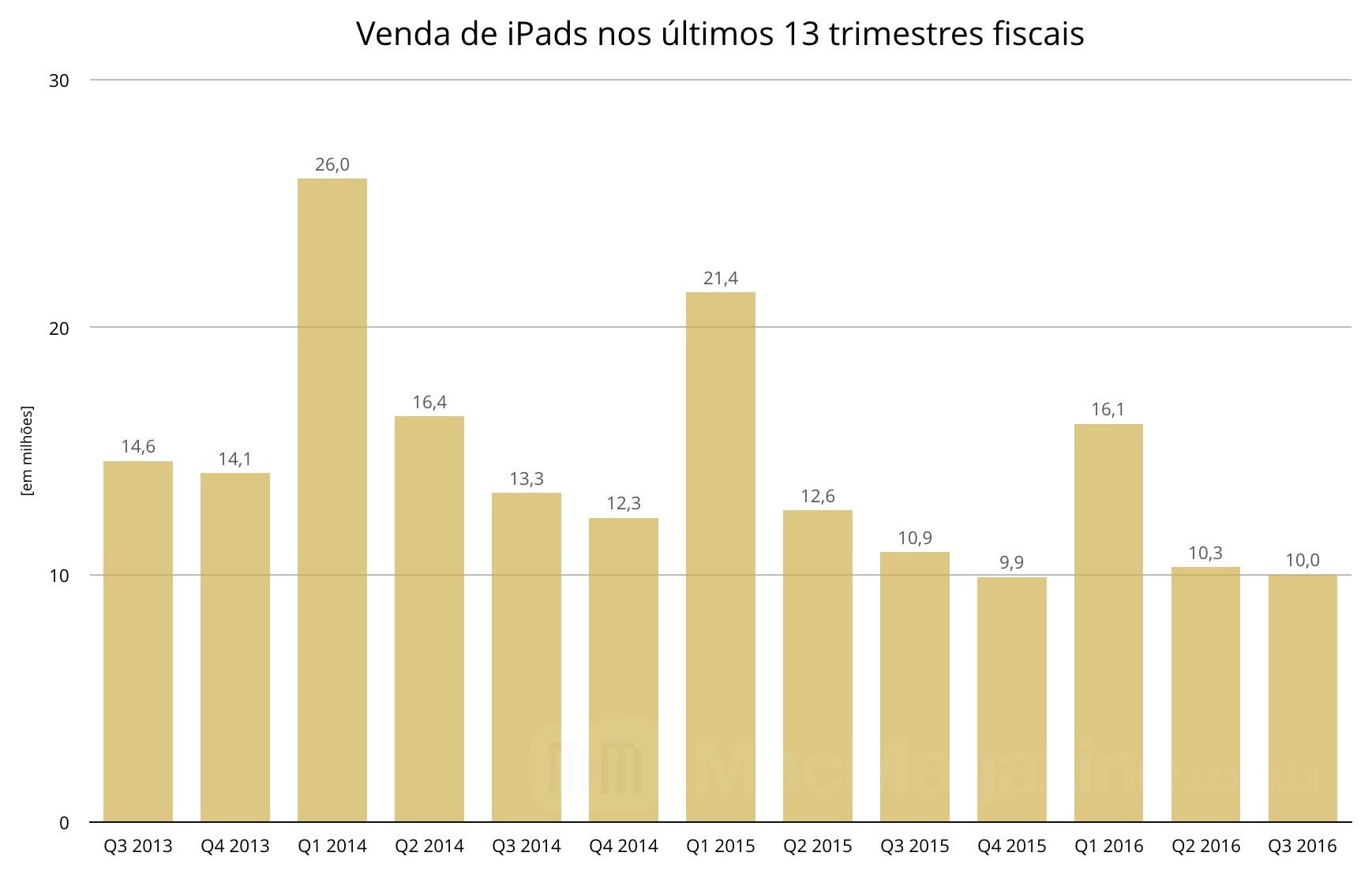

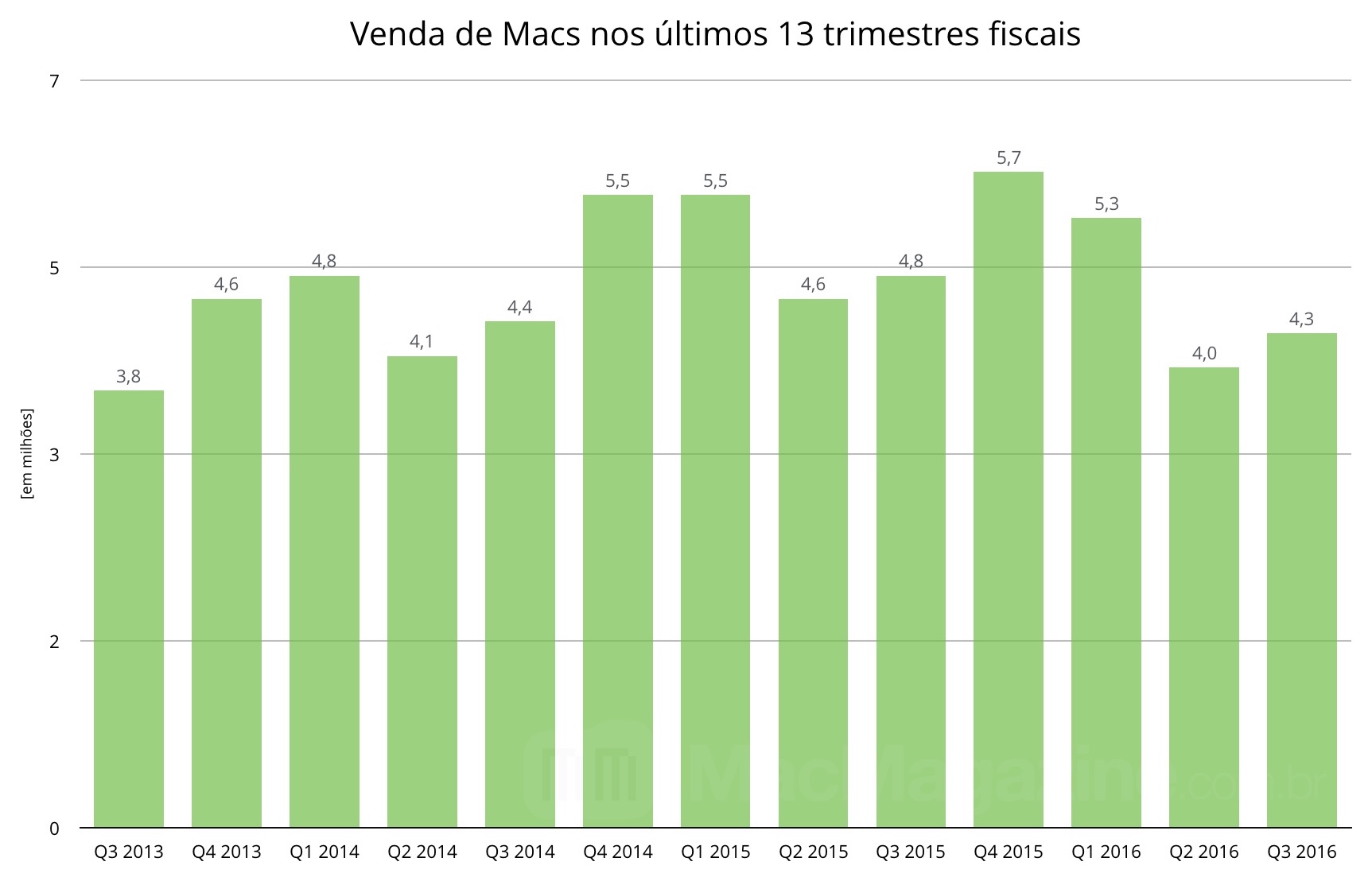

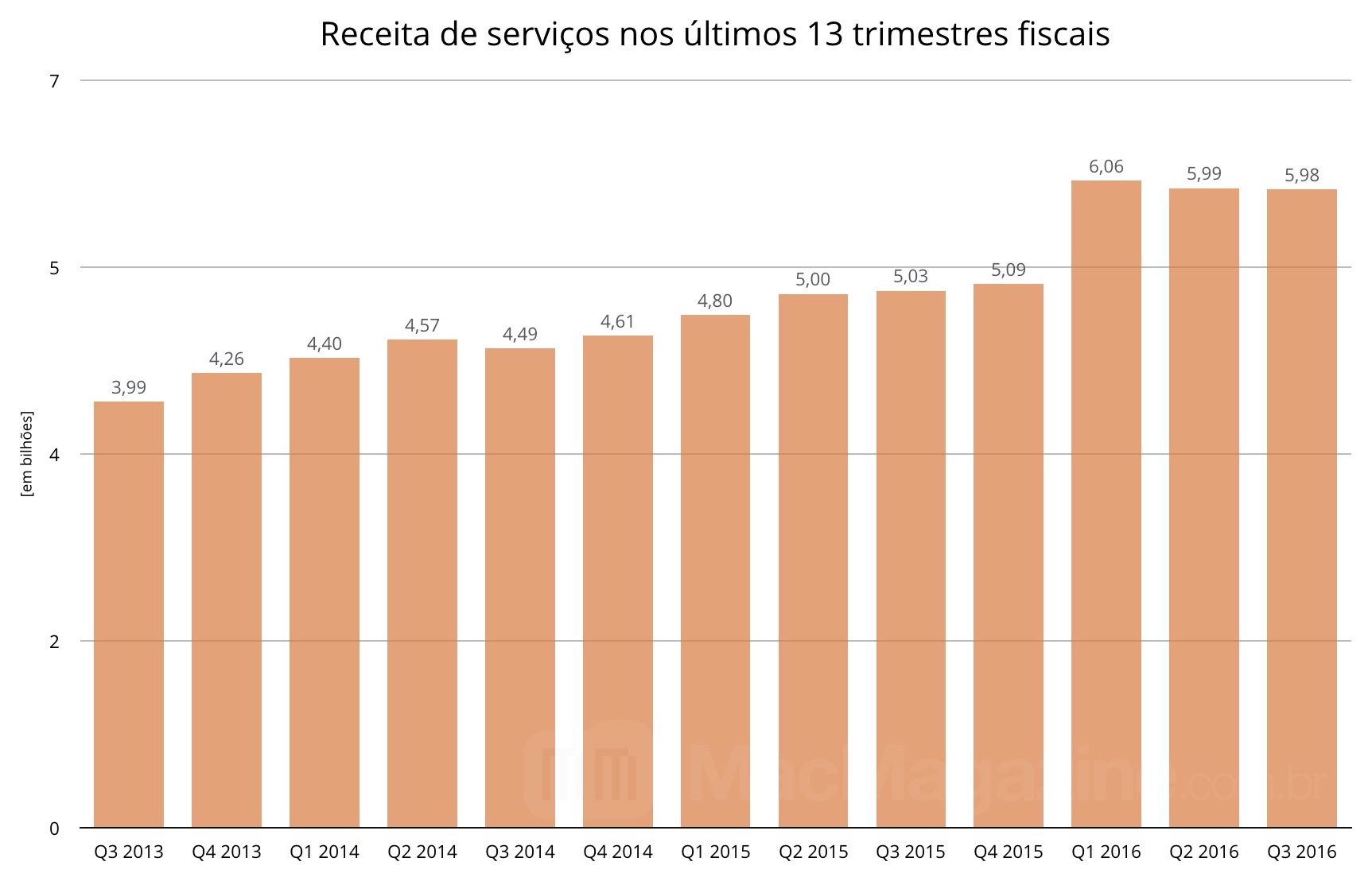

To recap: revenue in the quarter was $ 42.4 billion (against $ 49.6 billion in the same period in 2015), with a profit of $ 7.8 billion (against $ 10.7 billion) or $ 1.42 per year diluted (against $ 1.85 in 2015) and a gross margin of 38% (39.7% last year). The sales figures for iPhones, iPads and Macs were 40.4 million (-15%), 10 million (-9%) and 4.3 million units (-11%), respectively. The company's services (which include Apple Music, Apple Pay, App Store and others) had a 19% increase in revenues, totaling US $ 6 billion; j the “Others” category fell by -16%, with gains of US $ 2.2 billion.

As always, Tim Cook (CEO) and Luca Maestri (CFO) participated in an audio conference to explain and talk a little more about the details of these last three financial months of Ma. Let's go to the highlights!

General comments

- Cook commented on the new features of Apple's new operating systems (iOS 10, macOS Sierra 10.12, watchOS 3 and tvOS 10), emphasizing the investment that Apple has given to artificial intelligence. He said that Siri, for example, learns words, the intent behind them and can then offer more intelligent / accurate answers.

- As he always does, Cook said that Apple is preparing great launches for this year and that he is very optimistic about the future of the company.

- Apple now has $ 231.5 billion in cash, $ 1.4 billion less than in the last quarter.

- US $ 13 billion was returned to shareholders in FQ3 2016.

- Apple continues to acquire new companies at a monthly rate (from three to four weeks).

- Speaking specifically about the investment in Chinese Didi Chuxing (Uber's rival), Cook said that it is not normal, but that the company has already invested in the past in ARM, for example. The CEO also explained why he invested $ 1 billion in the company (financially it was a great deal for Apple; strategic things that companies can do together over the next few years; and the fact that Apple can learn a lot about the Chinese market with Didi).

- Asked about the division of research and development for existing products and those that have not yet left the paper, Cook replied that he would not speak exactly the slice of each, but that there is R&D for both categories. "You can look at the growth rate and conclude that we are doing a lot more than current products."

iPhone

- As a result of the iPhone SE's arrival in the quarter, ASP dropped from $ 642 to $ 595.

- The demand for the iPhone SE, incidentally, was greater than the offer in almost the entire quarter, which shows the strength of the device and how it could really impact the ASP of the smartphone.

- Interestingly, iPhone SE is performing well in both developed and emerging markets; it also has a very big appeal for those who are buying an iPhone for the first time and, obviously, for those who love the 4 ″ screen and was unhappy that Apple didn’t offer new hardware of this size.

- Maestri said there was no clear indication that the iPhone SE does not cannibalize sales of the 6s / 6s Plus. For Apple, this is an opportunity to bring even more people to your ecosystem, attracting new buyers and people who don't want to leave the 4 ″ screen behind.

- Percentually speaking, this was the best quarter in the migration from other platforms (especially Android) to the iPhone / iOS.

- The installed base of iPhone users in China grew 34% in the year.

- India is one of Apple's fastest growing markets today. IPhone sales in the country grew 51% year over year, in Ma's first three fiscal quarters. Cook confirmed plans to open stores in the country.

- Maestri said the iPhone remains out in the corporate market, with 75% of potential corporate buyers looking to buy a device in the fourth fiscal quarter of 2016.

- Cook said iPhone sales grew in two digits in the Japanese, Brazilian, Russian and Canadian markets. The information is interesting because it contrasts the data we released this week on the drop in sales of iPhones in Brazil even though the Gartner survey is related to the first quarter of the year and the data released by Cook, of the second quarter of the year (third quarter of the year). company), which already includes the iPhone SE.

iPad

- The iPad did the reverse of the iPhone. Due to the arrival of Pro models (more expensive than the old iPads), the ASP of the tablet rose from $ 430 to $ 490.

- Despite the drop in the number of tablets sold, the iPad had the best financial performance in the last 10 quarters, with revenue up 9%.

- According to company surveys, half of iPad Pro buyers are purchasing the tablet for work.

- In the US, among consumers who are planning to purchase a tablet in the next six months, 63% plan to purchase an iPad. Within that 63%, iPad Pro is the main choice.

- The satisfaction rate among corporate users is 94%; 71% plan to purchase a new iPad model.

Mac

- A year ago Apple had launched new MacBooks Pro and iMacs. Because of this, the comparison of sales of Macs was impaired this quarter.

- However, the Mac is attracting new buyers (who have never had a Mac before).

- The installed base of Mac users ended the quarter with a new historical record.

Services

- The App Store had a revenue growth of 37%, the highest ever recorded.

- Cook expects the “Servios” category to reach, next year, the size of a company worthy of the ranking Fortune 100.

- 75% of mobile payments are made through Apple Pay. There are currently more than 11 million payment locations / points in all countries that already support Apple Pay which is now in 9 markets, including 6 of the company's top 10 markets.

- The average amount spent by customers on transactions on the iTunes Store was the highest ever seen by Apple; the number of transactions also broke a record.

- Wanting to show that he is shedding his dependence on the iPhone, Maestri reported that the “Services” category now represents 11% of Apple's total revenues 3 percentage points more than a year ago.

- There are already more than 2 million applications available on the App Store.

- Apple is still trying to get the iTunes (Movie) Store and iBooks Store back to air in China. From a financial point of view, however, this blockade by the Chinese government does not represent much since the stores together made less than US $ 1 million (the period of this income, however, was not informed).

- Cook also talked about the Pokmon GO game, saying it is a testament to what can come with the launch of innovative applications. He also commented on the potential of augmented reality and that Apple continues to invest heavily in this area in the long term as it is a great business opportunity. "The first thing is to make sure that our products work well with this type of product, like other developers' Pokmons."

Other products / services

- Nothing about the Apple Watch sales was commented on; Cook only mentioned J.D. Power's satisfaction survey in which the Apple watch came in first.

- Asked about Apple TV, Cook said he thinks about the set-top box as a basis for what we can do. “I don't want to be more precise than that. Do not look at what is today and think that we have done what we want to do. We build a foundation on which we think we can do something bigger. ”

Future

- For FQ4 2016 (fourth fiscal quarter of 2016), Apple estimates revenue between $ 45.5 and $ 47.5 billion; comparatively, in the same period in 2015, revenue was $ 51.5 billion.

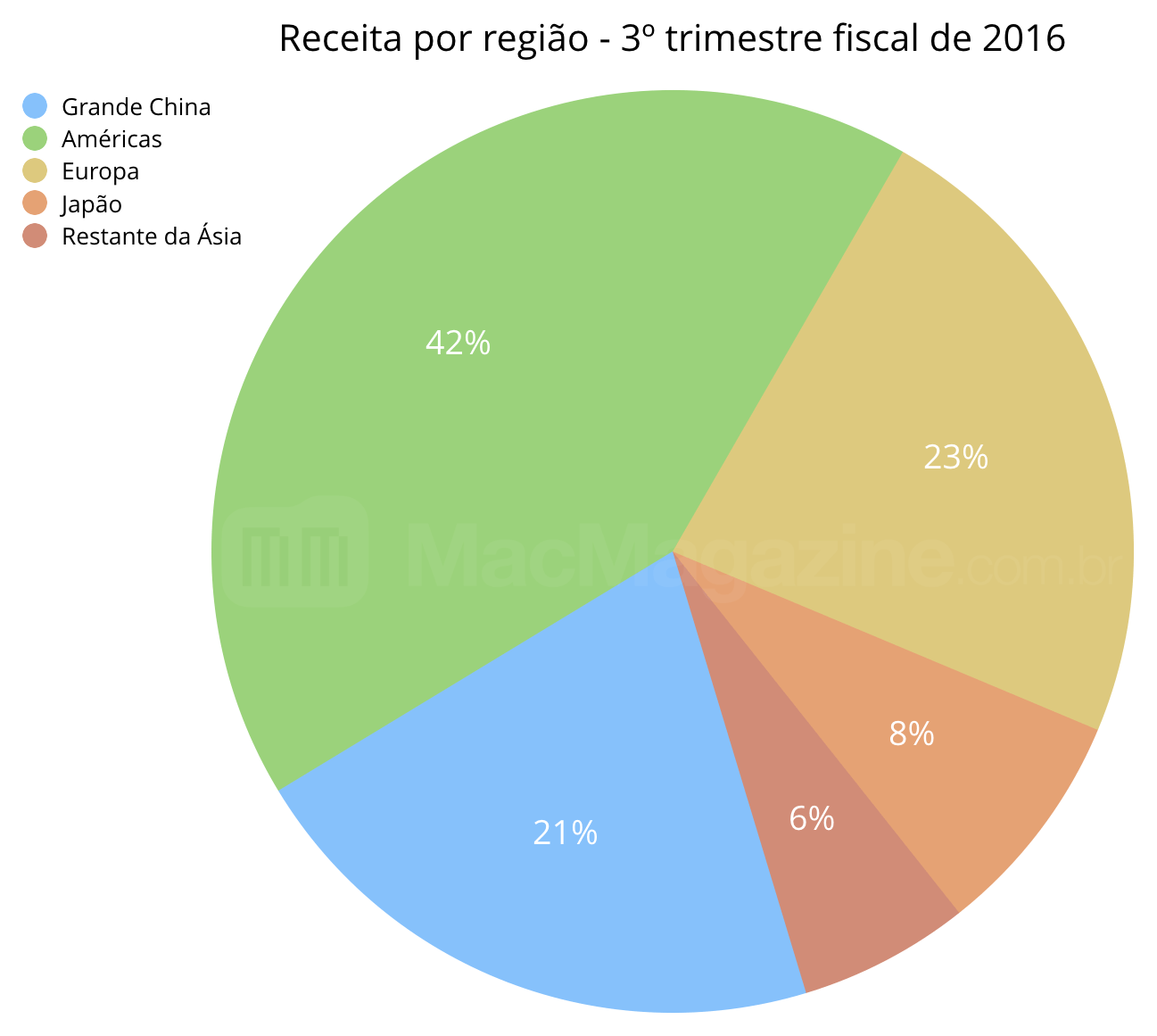

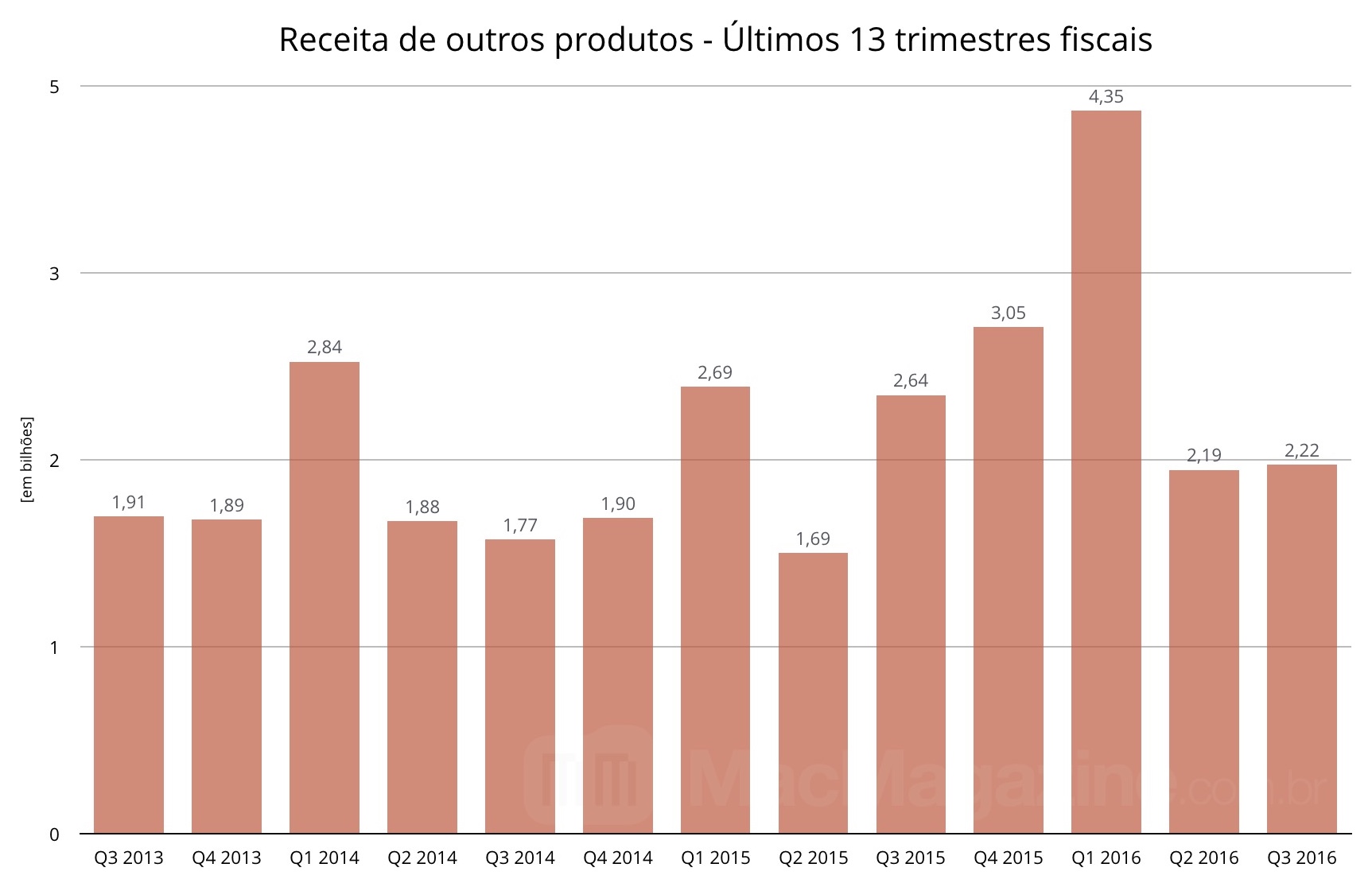

Graphics

Below, some interesting graphs that summarize Apple's third fiscal quarter of 2016:

· · ·

· · ·

· · ·

· · ·

· · ·

· · ·

· · ·

· · ·

(via MacRumors, AppleInsider, MacStories)