THE Apple Pay was launched in 2014, and the nearly five years of Apple’s mobile payment service can be described in just two words: a lot of expansion.

Although the growth is significant both in the American market and outside, there is still a lot of ground for Apple Pay (and other mobile payment methods), as seen in a new survey released by CNBC.

The “obstacle” to the growth of Apple Pay in the United States is not even the existence of competing platforms; after all, the Apple service is among the most prominent. In reality, it is the mobile payment system itself that fails to take off, especially in American territory (lagging behind other countries in terms of adopting these services).

According to data from CNBC, the most common payment method in the U.S. is the good old credit card (80%), followed by cash payments (79%) and debit cards (59%). Physical checks are in 4th place (53%), and only then does one of the first online payment methods appear, PayPal (44%). With a stark difference, Apple Pay comes in 6th place, with 9% of expressiveness.

This low adoption rate for mobile payment systems in general in the USA is even more contradictory when we analyze the “omnipresence” of iPhones and Androids in the country. In that sense, more than 81% of Americans own a smartphone and, although the future of online payment methods is promising, most users still see more advantages in traditional methods.

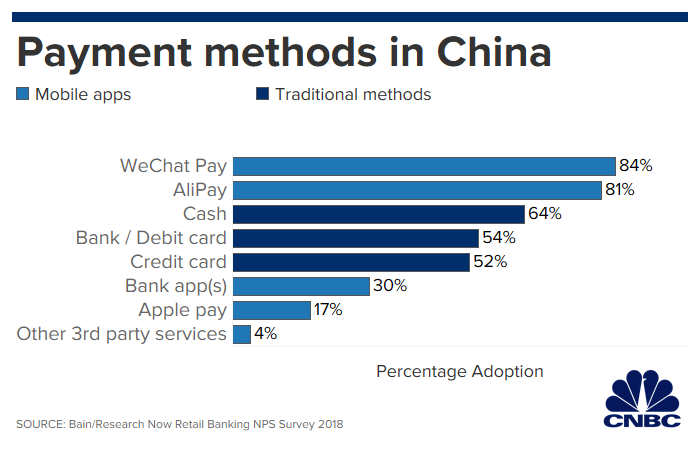

To get an idea of how low adoption of these services is in Uncle Sam’s land, data from CNBC show that the two biggest payment methods in China are mobile: WeChat, with 84%, and AliPay, with 81%. Only then does the money come (64%), followed by debit cards (54%) and credit cards (52%); in China, Apple Pay ranks 7th, accounting for 17% of total purchases in the country (more than in the USA).

A former Samsung Pay executive attributed the shyness of mobile payment methods in the United States to the lack of acceptance of this system over there:

Merchants need to reach a certain brand before consumers raise the possibility of switching entirely to mobile payment systems. There must be at least 90% acceptance for up to 1% of consumers to change their habits.

We’ll see if the Apple Card, officially launched last week, will be able to steer the adoption of its “brother” service (Apple Pay) in the USA. This is perhaps the biggest expectation of Apple, since the two services then closely linked and the Apple Card, in turn, offers a series of benefits that may attract even more customers.

via AppleInsider