Internet banking has become popular due to its practicality, allowing the user to access balance, statement, investments and bill payment information by cell phone or computer, without facing queues at the bank. However, with the increasing number of frauds, scams and fake websites, the online service still raises many doubts among users who use a bank website or application, especially in terms of security.

READ: New scam steals bank details of thousands of Brazilians

Although internet banking is a reliable way to do online banking, websites and computers have vulnerabilities that can be exploited by criminals. Thinking about it, dnetc prepared a guide to answer questions about service and security on bank websites.

Bank sites: security questions and answers – Photo: Pond5

Want to buy cell phones, TV and other discounted products? Discover Compare dnetc

What is internet banking?

Internet banking is the online version of your bank. The service allows the user to carry out transactions on his account over the Internet, without having to leave home to go to a bank branch. Through internet banking it is possible to make transfers, pay bills and bills, recharge cell phones, access limits and even check the bank statement.

Internet banking can be accessed through the bank’s website on desktops, or via mobile applications – Photo: Rodrigo Fernandes / dnetc

How to access the bank website safely?

As much as bank sites offer their own protection to customers, it is still necessary to take security measures to avoid being the victim of a scam on the Internet. Check the list of bank website recommendations in the list below to ensure safe browsing on your computer.

1. Do not access the bank’s website on shared computers

Public computers in internet cafes, hotels and other places may have viruses or malicious software capable of stealing data from your account. Prefer to use your personal computer to access your bank details.

2. Do not access the bank’s website on public Wi-Fi networks

As much as public Internet networks offer economy and convenience, they are fragile in terms of security. Since anyone can access public Wi-Fi, their data is unprotected and can be captured by other users or even criminals.

Do not access the bank’s website on public Wi-Fi networks or shared computers – Photo: Disclosure

3. Keep your PC’s antivirus up to date

Install antivirus on your computer and mobile phone and keep it updated to protect yourself from virtual threats. There are options for free programs to download on dnetc, such as McAfee, Avast, Avira, among others.

4. Enter the website address in the browser

Try typing the address (URL) of the bank’s website in your browser, instead of searching for it on Google or another search engine. Fake and malicious websites can appear in the first results, confusing the user.

5. Enable two-step verification

Most banks have security modules in the form of programs for the computer, or through a token – sent by SMS or in the mobile application – to confirm any type of online transactions. In this way, only the user can authorize actions on his account, making theft and fraud more difficult.

It is also advisable to enable two-step verification to ensure the security of your bank details. If you don’t know how to activate the feature, go to your bank’s website and search for the security part to learn about your agency’s protection services.

Keep your PC’s antivirus updated so you don’t run the risk of hackers stealing your bank details – Photo: Pond5

6. Don’t click on bank links received by email

Banks do NOT request passwords, personal details or bank details by email. Therefore, be wary of emails that contain attachments, links to offers, Portuguese errors and unknown senders. If you receive a message like this, delete the email. And don’t click on links or attachments, as they may contain viruses or malicious programs. This same type of scam can also occur via SMS, so be careful with text messages of this type.

7. Be careful when using extensions in the browser

Bank extensions for browsers have useful features, but can put your computer’s login data and passwords at risk. An extension can contain malicious programs, such as keyloggers, that monitor browser activity and can register the keys you press. Therefore, avoid using extensions and give preference to software and applications offered by your bank’s official website.

How do I know if a bank website is secure?

To find out if a bank website is safe, look for the green padlock symbol in the left corner of your browser’s address bar. The icon shows that the site uses an SSL certificate, indicating that your information is private when sent to this address. If the browser points out problems with the website’s certificate, be wary.

Check if the connection is secure before entering your bank details on the internet – Photo: Reproduction / Tais Carvalho

How do you know if a bank website is fake?

A trick in the URL can trick users with fake pages, putting their bank details at risk. Phishing scams, cybercriminals’ technique for stealing information, use fake websites to trick users. Therefore, before entering a login and password, check that the bank’s URL uses «https» and that it is spelled correctly, without special characters.

These scams usually occur when a user clicks on a suspicious link or attachment that has been sent by SMS or email. As previously mentioned, never access your bank in this way. Follow the security guidelines and enter the address (URL) in your browser.

Always enter the internet banking URL in full – Photo: Pond5

Contrary to what many people think, Warsaw is not a virus or a suspicious program. It is legitimate software developed by Gás Tecnologia, a Diebold group company, used as protection technology by Banco do Brasil, Itaú, Caixa Econômica Federal, Santander, among other agencies.

The plugin starts with Windows and has the function of ensuring the security of transactions carried out online by customers. If you still want to uninstall the program from your computer, learn the steps to remove Warsaw.

How do I shop with boleto bancário on the internet? Users respond in the dnetc Forum.

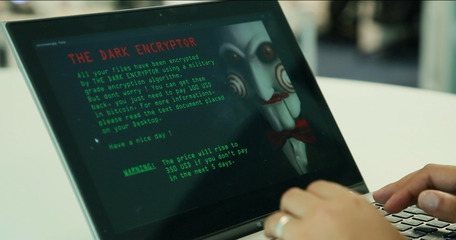

What is ransomware: five tips to protect yourself from cyber scam