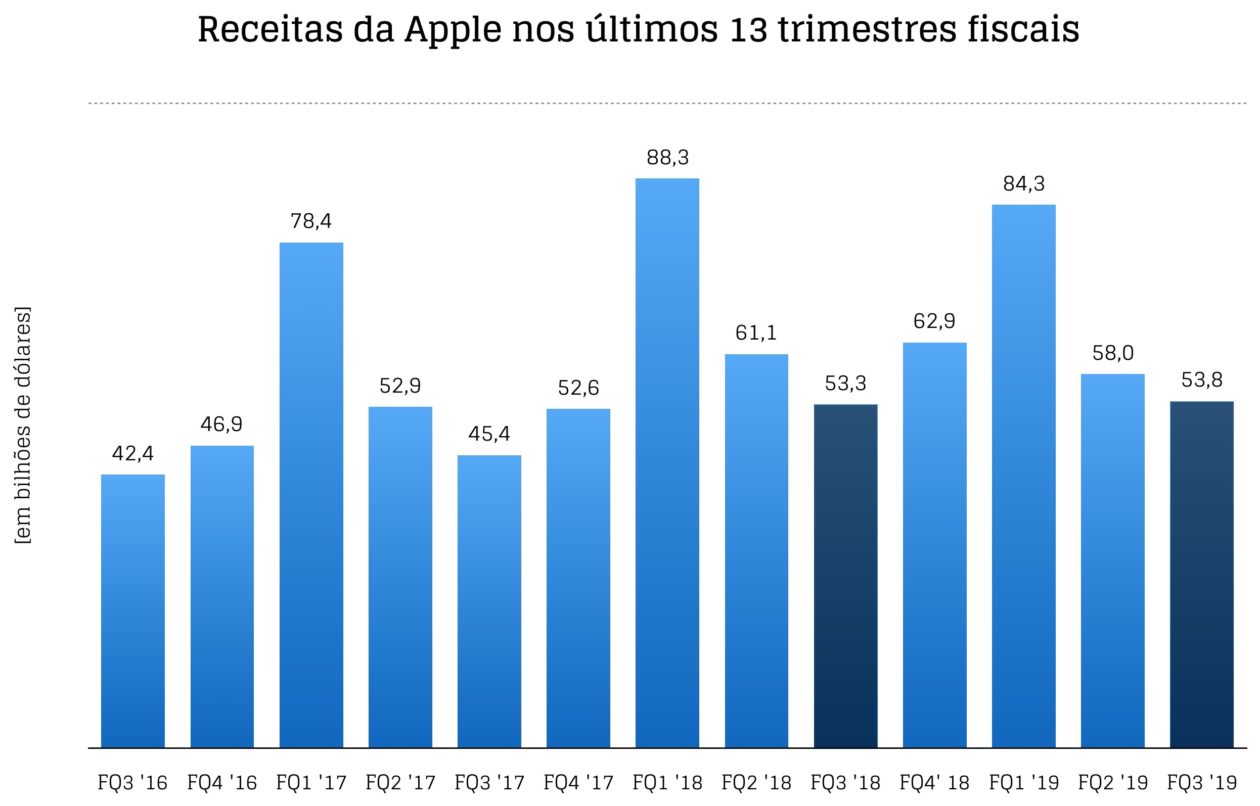

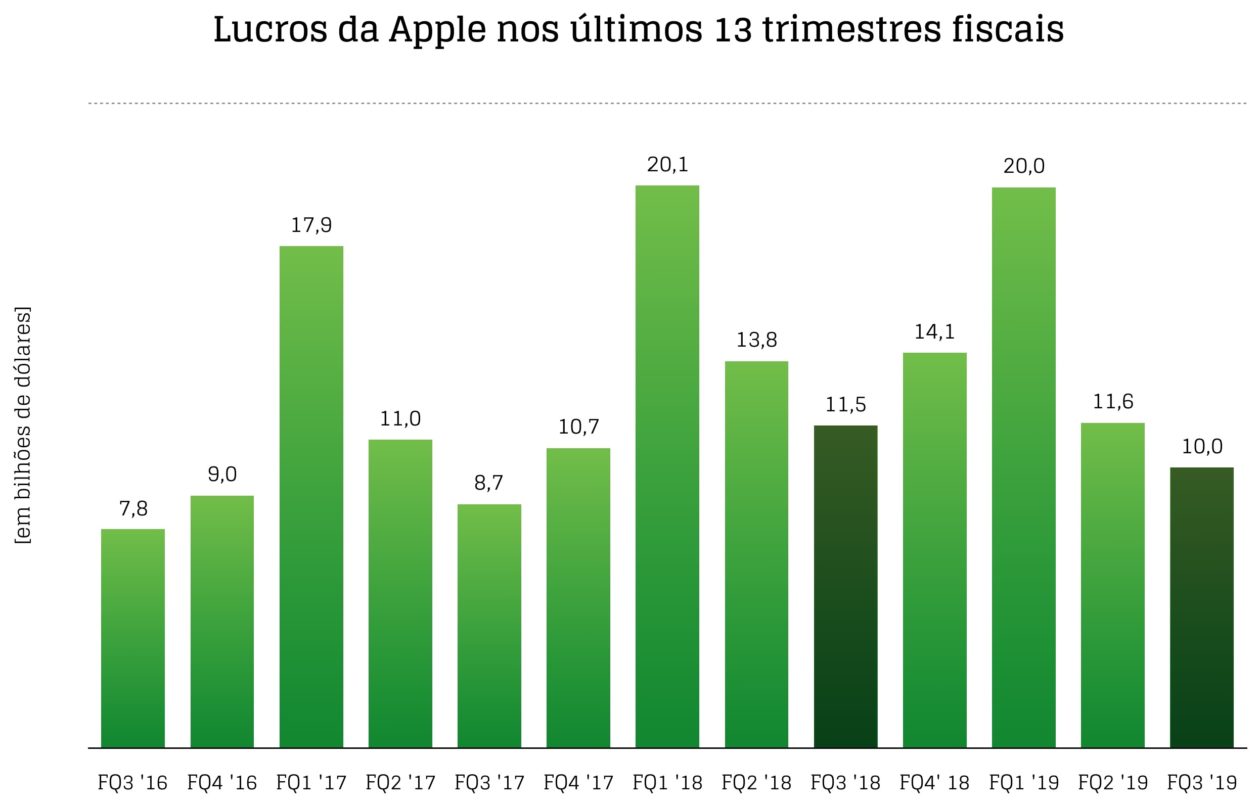

As expected, Apple yesterday released the financial results for its third fiscal quarter 2019. Revenue in the period was $ 53.8 billion (0.9% more compared to the same period in 2018), with net income of $ 10 billion (-13%) and diluted earnings per share of $ 2.18 (-6.8%). International sales comprised 59% of all quarterly sales and the gross margin in the period was 37.6%.

As usual, the CEO Tim Cook and the CFO Luca Maestri held an audio conference to announce the results and comment a little on the company’s performance in the last period – and the projection for what is yet to come.

In this event, whether during the speeches of the executives or in the question and answer session with analysts / journalists, they always paint interesting information. And we, of course, follow everything closely to bring you the highlights of the last quarter of the Apple.

Money that never ends

The company’s financial results were as expected by Apple, which had estimated revenue of $ 52.5-54.5 billion and a gross margin between 37% and 38%. With that, the company now has approximately US $ 211 billion in cash.

Although it is a substantial amount, it represents a 6% drop compared to the previous quarter, largely due to the share buyback program – for one idea, only in the third fiscal quarter of 2019, Apple repurchased 88 million shares (investment of US $ 17 billion).

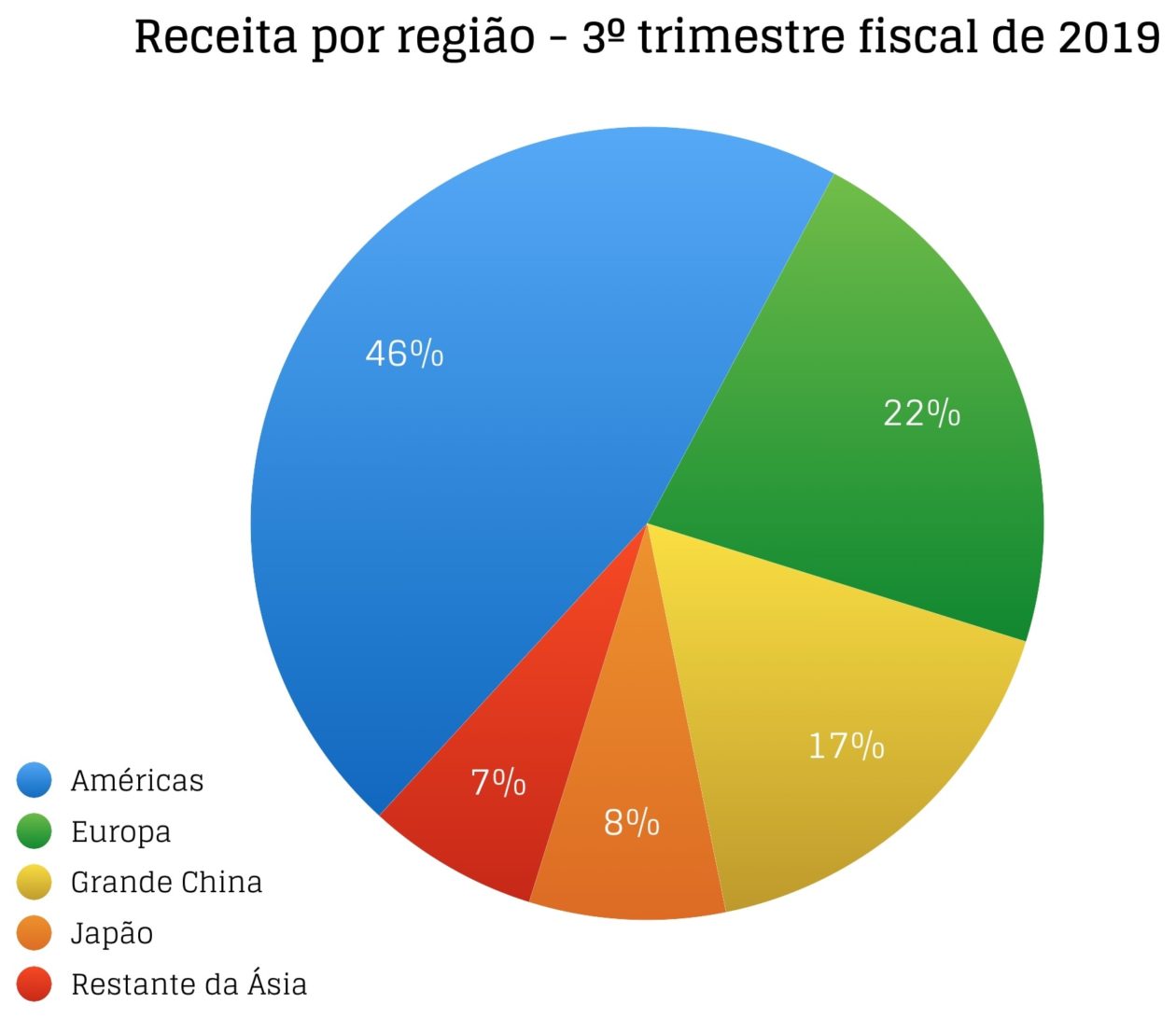

Growth in all regions

According to Cook, Apple’s revenues grew in all regions where the company operates, in all product categories (with the exception of the iPhone). This was also the best fiscal third quarter for Apple Retail Stores (there are currently 506 stores in 22 countries).

Even in China, where Apple was struggling, things are looking up. According to Cook, the company saw major improvements in the country (both in sales of iPhones and in products in other categories), growing again there. The Services segment had a double-digit growth, mainly due to the performance of the App Store.

Maestri commented that Apple achieved significant improvements in revenues in emerging markets; in India and Brazil, the growth was double-digit; in Vietnam and the Philippines, the company set new records for the third fiscal quarter.

iPhone falling; other compensating products

The drop in the iPhone segment was quite large, at 10.9%. Even so, the installed base of the smartphone reached a new record in all segments where the company operates.

Even with the fall of the iPhone, the commercial performance of the other segments (Mac, iPad, Wearables, Home and Accessories, and Services) more than made up for this loss.

In fact, it was the first time in the recent history of Apple that, together, the values of these segments exceeded the revenue of the iPhone (US $ 27.7 billion vs. $ 25.9 billion), showing that Apple is moving towards becoming less and less dependent on the revenue generated by its smartphone.

Taking the iPhone out of the picture, product categories grew by 20%! Still, Maestri said the iPhone had improved its performance year on year in 15 of the company’s 20 largest markets. The iPhones upgrades program grew 5x compared to the same period in 2018.

Speaking specifically of the Mac, the fiscal quarter was record high in the US, Europe and Japan – numbers far removed from the PC industry as a whole. The segment grew in four of the five regions where Apple operates, reaching the largest installed base of Macs ever seen.

The iPad grew in all five geographic segments – this was the third quarter in a row that the iPad’s numbers grew; more than half of the customers who purchased iPads during the quarter were new; the active installed base of iPads has reached a new record!

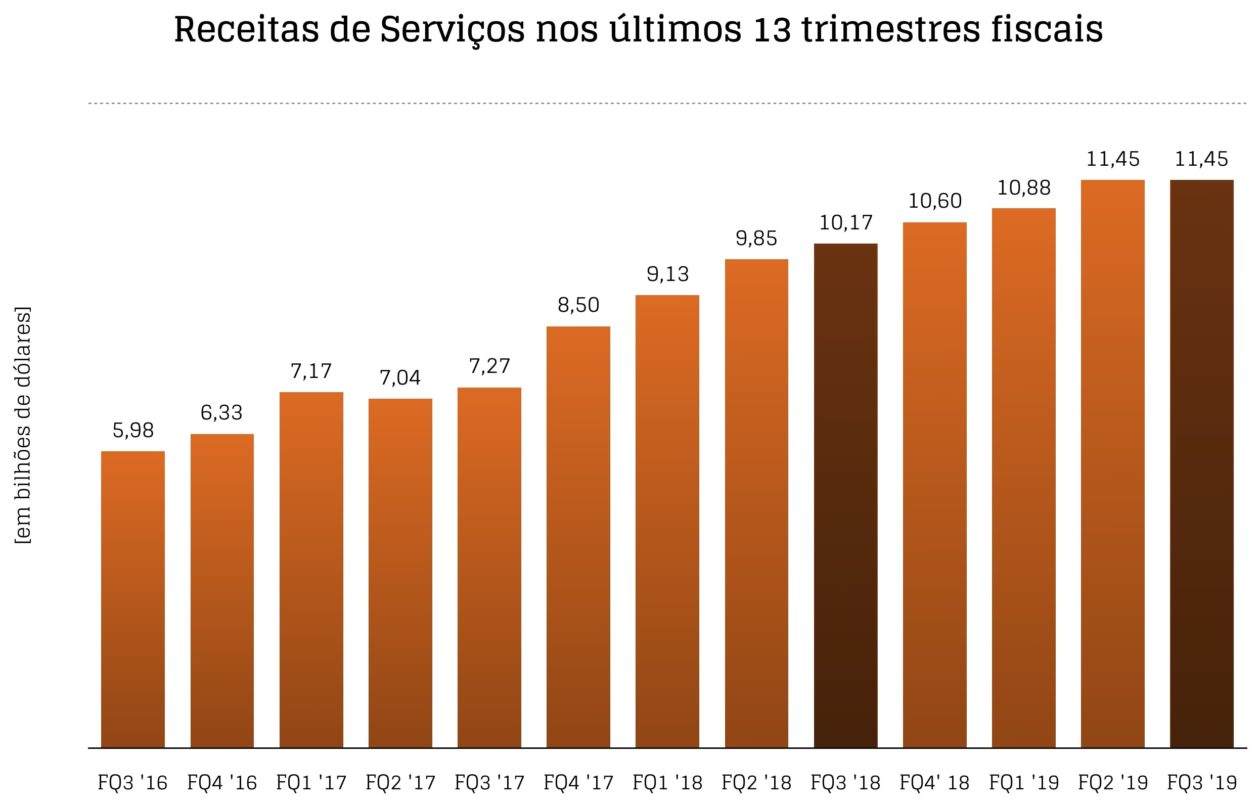

Record from the App Store; Apple Pay taking off

Services continue to do well. The App Store, for example, set a new record for the third fiscal quarter, with double-digit growth. Others that had similar growth were Apple Music, iCloud and AppleCare + (his best fiscal quarter, inclusive). Ads on the App Store, in turn, grew by three digits!

App subscriptions offered by third-party developers grew 40%, according to the Apple CFO.

The company surpassed the barrier of 420 million subscribers paying for some service (be it Apple Music, Apple News + or space on iCloud – remembering that Apple Arcade and Apple TV + will soon join this catalog of offers). In 2020, the company is expected to exceed 500 million subscribers.

Apple Pay, on the other hand, is completing 1 billion transactions per month, twice as much as a year ago. Available in 47 markets, Apple’s payment service gained more new users in the fiscal quarter than PayPal, with transaction volume growing 4x faster. Service growth in the quarter was three digits!

Apple Card coming in August

As we have already mentioned, Cook confirmed that several employees are testing the Apple Card and that the company’s credit card will be launched (in the United States only) in August.

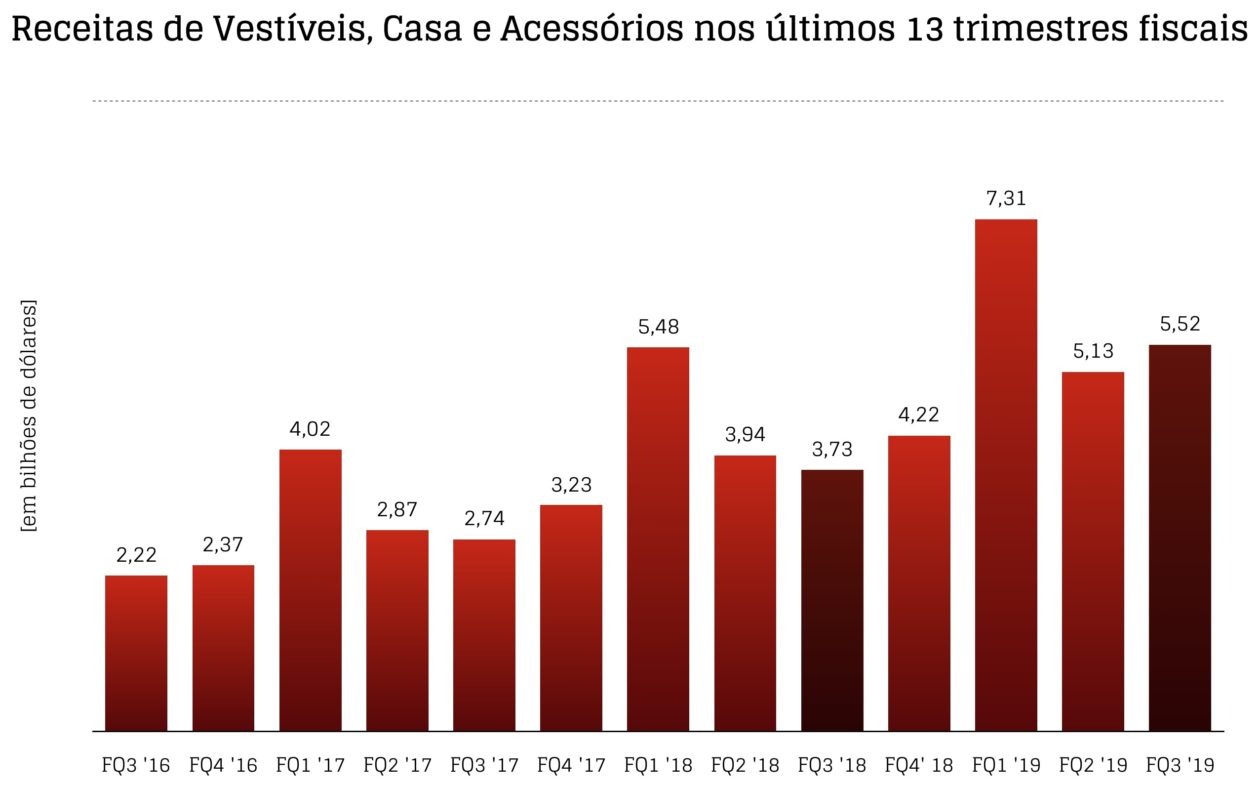

Wearable on fire

The revenue generated by “wearable” products (Apple Watch, AirPods and Beats headphones) grew in the quarter by more than 50%. With that, only this category of products could already be included in the ranking Fortune 200.

It is worth noting that Apple TV and accessories had double-digit growth. And since we’re talking about Apple TV, the new app had a 40% increase in views compared to the same period in 2018.

Speaking of the Apple Watch and the ECG app, one of the strengths of the Apple Watch Series 4 that allows the execution of an electrocardiogram in a very simple and easy way, it is now available in 31 countries / regions – after launch in Canada and in Singapore in the last week. By the end of the year, Apple plans to expand further.

Business with Intel

Cook recalled that last week, Apple announced the acquisition of Intel’s smartphone modem business – the company’s second largest acquisition in value ($ 1 billion, second only to the purchase of Beats, for $ 3 billion).

The CEO welcomed Intel employees who are now part of the Apple board and recalled that the company is keen to control the creation / production of essential components for its products.

Asked about the management of 5G during the question and answer session, the executive stated that he does not comment on future company products, but said that 5G is still in a very early stage, mainly thinking globally – which matches the rumors that we’ll only see an “iPhone 5G” in 2020.

User satisfaction

According to Maestri, combined, the iPhones XS, XS Max and XR reached 99% user satisfaction – data from the company 451 Research.

IPads, according to the same research firm, have a 94% user satisfaction rate.

Production in China

During the question and answer session, Cook was asked about Apple’s production in China. The CEO responded by saying that there has been a lot of speculation about this, but that it is not necessary to pay so much attention to the matter. He also said that parts of Apple products come from everywhere (China, Korea, Japan and the United States).

In addition, the executive stated that the Mac Pro is currently made in the USA and that Apple would like to continue manufacturing the product in his country.

New business

According to Cook, 2/3 of the major banks (he did not specify which regions) are implementing Apple products; 90 of the top 100 banks by assets are switching to using the company’s products.

The fiscal quarter in graphics

· • ·

· • ·

· • ·

· • ·

· • ·

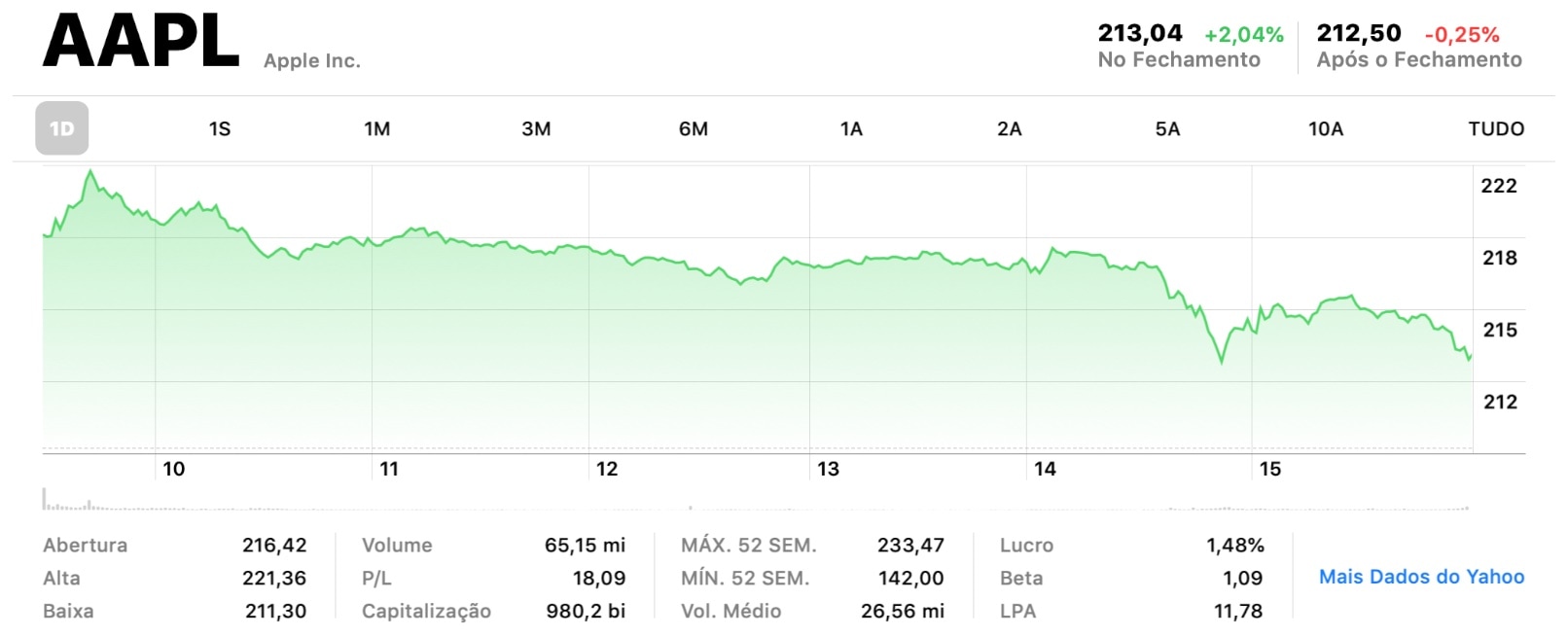

Wall Street reaction

Yesterday, shortly after the results were released, Apple’s shares soared more than 4% in post-closing negotiations and, if it maintained the same level today, the company would once again overcome the barrier of $ 1 trillion in market value.

Although the big increase was not confirmed, the papers closed the day worth US $ 213.04 (2.04% increase). In this way, the market cap of Apple stood at US $ 980.2 billion.

Forecasts for the fourth fiscal quarter of 2019

For the fourth fiscal quarter of 2019, Apple predicts revenue of $ 61-64 billion, gross margin between 37.5% and 38.5%, operating expenses between $ 8.7 and $ 8.8 billion, other revenue / (expenses) of US $ 200 million and a tax rate of approximately 16.5%.

via MacRumors, AppleInsider, MacStories