This is a delicate matter and our intention is not to own the truth or even defend Apple tooth and nail here. We are all in the same boat and we are not crazy to think that the current prices of Apple TV (from R $ 1,350), Apple Watches (from R $ 2,900), iPad Air 2 (from R $ 3,400), iPhone (R $ 4,000 for a 16GB device, p!), the 21.5 ″ iMac with Retina 4K screen (R $ 14,300 and comes with a 5,400RPM HDD!), the 15 ″ MacBook Pro with dedicated GPU (R $ 23,500), Mac Pro (from $ 30,500) are great. Of course, it is not. A simple cord to hold the Apple TV remote control in Brazil costs more than R $ 100 in Brazil and this, in a way, is unacceptable.

But before leaving for cursing Apple a lot on Twitter, our obligation is to stop for a while and think about the Brazilian scenario in general. Is it just with Apple? Or are we in a country where the vast majority of things have exorbitant prices? O MacMagazine a technology site, so let's focus on this area.

We know that the final value of Apple products in dollars is not the same as distribution for them to be resold by. But it still serves as a good basis and as a reference for the argument.

The reader Rodolfo Caliman reminded us that Xiaomi today is one of the most aggressive companies when it comes to price. She, who has the Brazilian Hugo Barra as vice president, recently landed in Brazil. The Chinese company sells the MI BAND for $ 15 l abroad, practically the same price as Apple TV's Remote Loop in the US ($ 13). Here in Brazil, the bracelet arrived in early July (when the dollar was worth about R $ 3.11) costing R $ 95; the Remote Loop has now arrived (end of October), with a dollar worth about R $ 3.87 and a final price of R $ 109. Similar, no?

We may even question the Apple string costing the same as a fitness bracelet, but it goes with the strategy of each company. The point here is not to discuss whether $ 13 is expensive for the product, but if you get here for $ 109 correct.

This Remote Loop price structure ($ 13 multiplied by the dollar quote, multiplied again by two), we can see in virtually all Apple products. Although there is a good variation, there is a standard a. Do the math yourself.

The 38mm Apple Watch Sport, for example, costs US $ 349 in the USA (this without taking into account local taxes, to facilitate the account). Well here in Brazil it arrived costing R $ 2,900. Making this account very basic that I commented, we arrived at a relatively close value (~ R $ 2,800 using a dollar to R $ 4,00).

The 15 ″ MacBook Pro with top-of-the-line Retina display? You can make the same calculation that it will also be close, for about R $ 20,000 (a little more distant than the previous examples, but still not so far from reality). And the story is repeated for the iPod nano (~ R $ 1,200), the 21.5 ″ iMac with Retina 4K screen (~ R $ 12,000), the Mac Pro (~ R $ 24,000 and ~ R $ 32,000), the Apple Watch Edition top line (~ R $ 136,000), etc.

Playing on the tributado.net website, it is easy to see that, when importing a product, the final value of it (including import tax and ICMS, only) practically doubles the price, confirming the very rudimentary calculation that we did above talking about import tax only. and ICMS, forgetting all the rest related to imports (freight, insurance of goods, etc.).

It is clear that the products are not imported at the final price (which we see on American shelves), but we must not forget that there is a commercial chain before they reach the hands of consumers here in Brazil (importer, retailer, retailer).

Apple cannot skip or ignore this chain, as it currently does not yet have stores covering the entire national territory and perhaps that is not even the company's strategy. Each, with their slice of the pie, contributes to the price. Obviously this is not something exclusive to Brazil, but as always, here everything is more representative.

Returning to products, the iPhone is a case because, as we already know, it is assembled here in Brazil and that helps Apple when it comes to market it in national territory. Proof that the entry-level model of the iPhone 6s was launched in Brazil for R $ 3,999, a little more expensive than Samsung's latest releases in Brazil (Galaxy S6 Edge + for R $ 3,999 and Galaxy Note5 for R $ 3,799), but cheaper than than Sony's latest release (Xperia Z5 for R $ 4,299). Like the 16GB iPhone 6s, the Xperia Z5 sold out for about $ 650 (or less).

According to the rule we stipulated above, the iPhone 6s 16GB would arrive here costing easily ~ R $ 5,200, something that fortunately did not occur and does not occur with any other company when it comes to smartphone.

But going back to the prices of products here in Brazil and comparing everything with American values, there are many things that are outside our accounts and that must be taken into account. The first is that all these comparisons must be made with the values seen by Apple Brazil, which have a 10% discount none of these values that I put above include these 10%, making the comparison a little more credible, inclusive.

The second is that, in the USA, interest and inflation are highly stable, quite different from Brazil. And this directly influences the import of these devices, after all, many of the services provided on national soil until the Apple product is on a shelf to be marketed (whether physical or online) are directly affected by this.

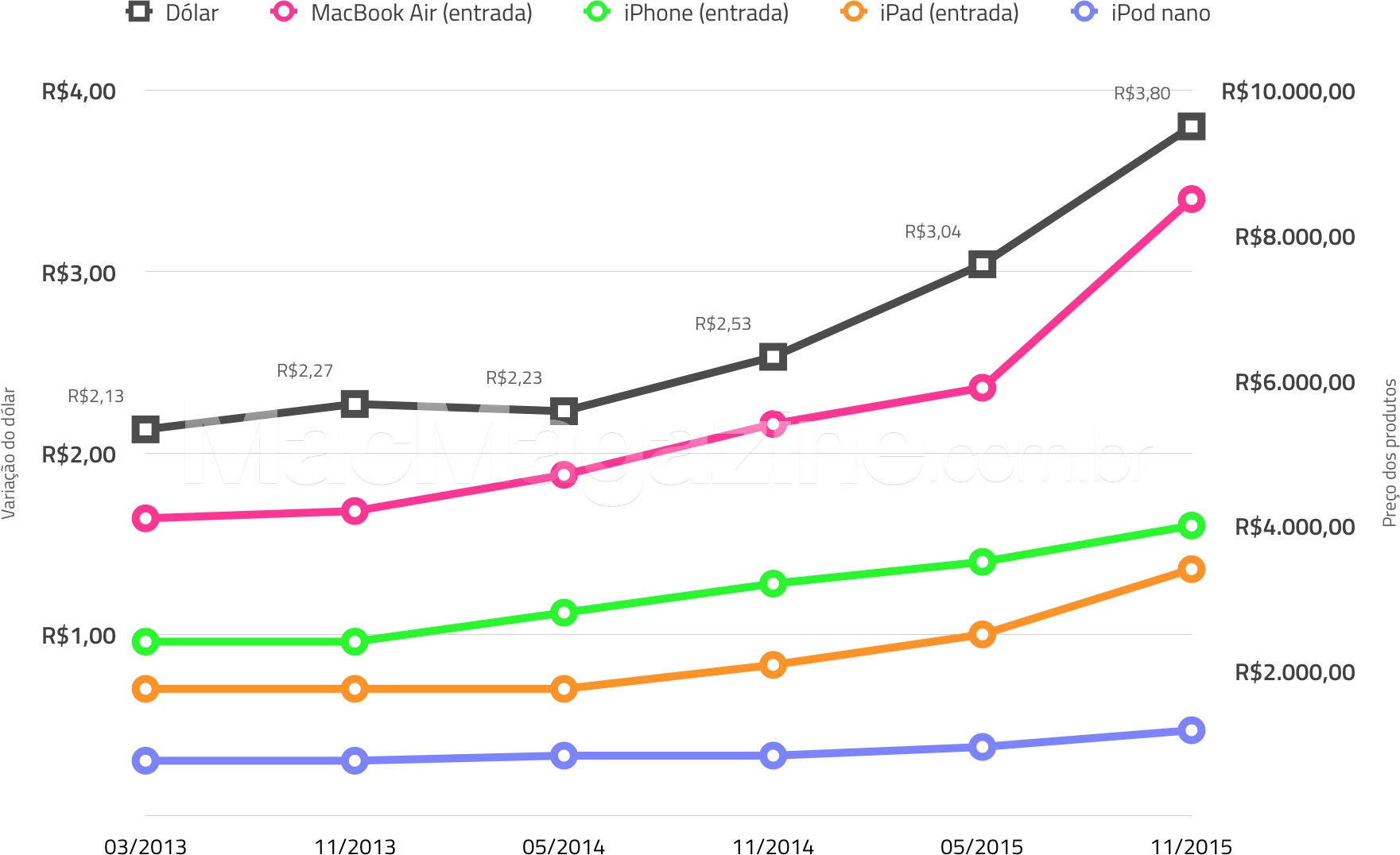

For some time the reader Marcus Flavius Damasceno had given us the idea of making a comparison between the readjustments of Apple products here in Brazil and the surge in the dollar, to see if the company is just correcting prices according to the currency variation or if there is a real price increase (higher than the exchange variation). We investigated this, using four products as an example:

Note that the product price curves do not differ that much from the dollar.

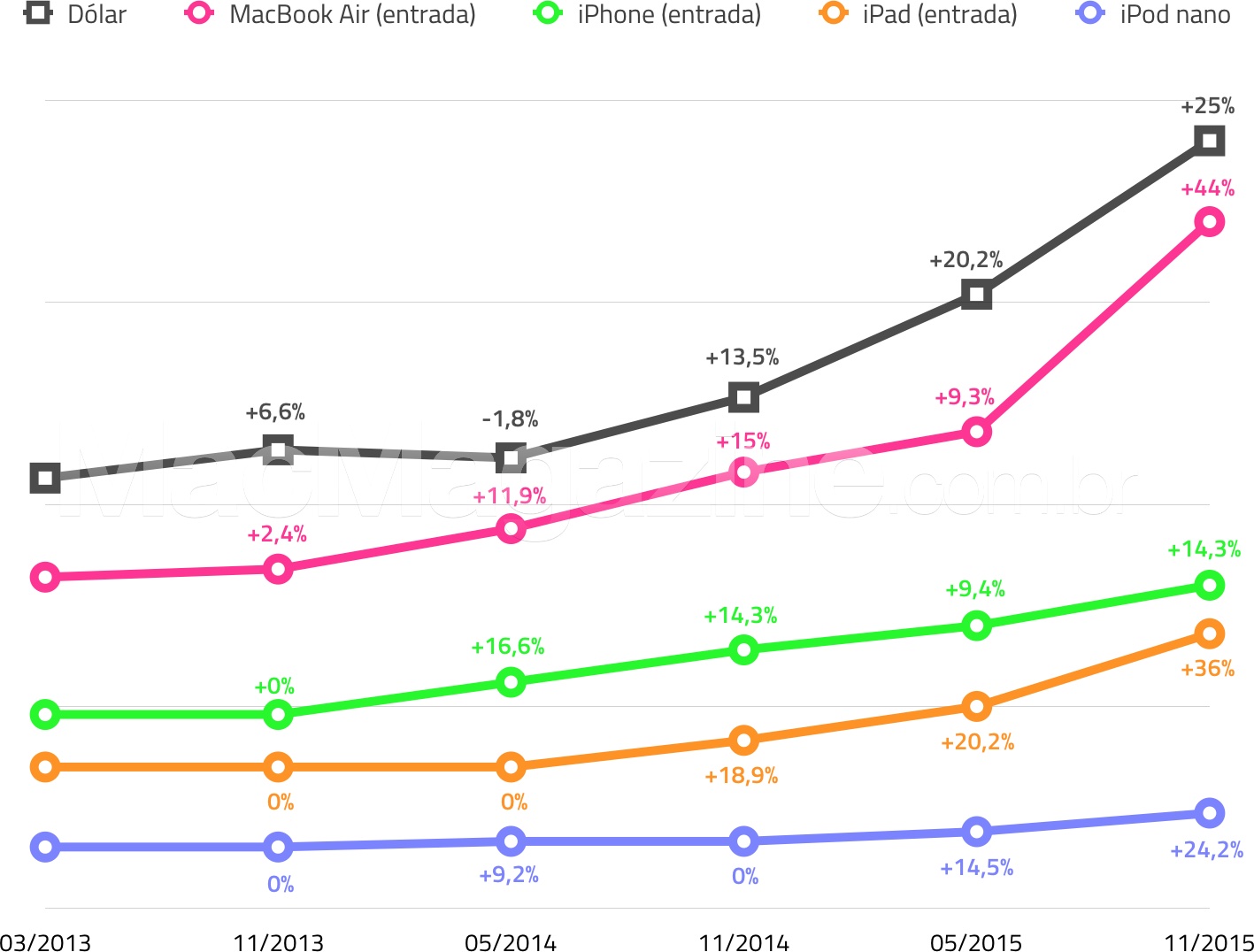

Below, the percentage representation of these variations (both dollar and products):

The total variations (November 2013 to November 2015) were as follows:

- Dlar: 78.4% increase

- iPod nano: 55.3% increase

- iPad: 94.3% increase

- iPhone: 66.7% increase

- MacBook Air: 107.3% increase

Comparing directly with the increase in the dollar, the iPad and MacBook Air are at odds while the iPod and iPhone are even below. Without wanting to pull sardines for Apple, but this comparison ends up being unfair because, as I said above, it does not take into account taxes (which may vary depending on the product) and services whose inflation in our country directly influences (freight, insurance, etc.). ). To top it off, due to the current volatility of the American currency, Apple Brazil certainly gives a good margin when setting prices, otherwise it would have to make adjustments from month to month.

In the chart below, we take the value of the products in reais and divide them by the dollar quotation for each season, thus reaching the “dollar value” we pay here:

This graph is interesting because it shows us that, converting the value in reais to dollars, we have the cheapest iPod nano and iPhone (in this period of three years of comparison); on the other hand, the most expensive iPad and MacBook Air of the period.

Taking the minimum and maximum value of the products during these three years, we have the following variation:

- iPod nano: $ 61.49

- iPad: $ 123.99

- iPhone: $ 212.06

- MacBook Air: $ 386.80

To build these graphs, we used the current date as a base and went back in time every six months, analyzing the prices and the dollar quotation at the time. This does not mean that the prices of the products increased exactly in the periods highlighted by us. The idea of the graphics will only have an overview of prices and the dollar in these three years.

Would Apple be able to improve prices in Brazil? I think so. I would venture to say that certainly yes, either by reducing your profit margin or, who knows, installing factories for various products (not just iPhones and iPads), gaining incentives that can eventually be passed on to consumers.

A few weeks ago the reader Bruno Coelho Leuenroth sent us an email and raised interesting points for this discussion. Does Apple have an abusive profit in Brazil? Profit profit and when it doesn't reflect the value that people see in that product, they just stop buying. Apparently, this has not yet happened to Apple here.

Making a somewhat surreal parallel, but necessary to understand all of this, imagine the life of a small, independent developer. Let's funnel more: independent and Brazilian developer, acting basically in the national market and with apps available only on the App Store. Let's say he has several apps for sale for $ 4.99 each. This increase in the dollar must have affected the life of this person a lot, after all, in a “short time” his product cost R $ 12.50 and went to R $ 20.00 due to the variation of the dollar.

Most likely, this developer had to review his concepts and lower the prices of his apps to continue selling at the necessary pace. Was it his will? Probably not, but if he didn't, the consequences could be disastrous.

This parallel can be done with several companies, but not with Apple. It does not suffer from this because the supply / demand laws totally favor the company. We are talking about a company that, for much of the year, is unable to produce the amount of products that people want to buy seeing Apple taking months and months to regularize inventories is not unusual. It simply does not need this (lower prices), after all, how to explain to shareholders that the company reduces its margin well in a specific country (which is definitely not yet as representative in Ma's accounts) at the same time that it cannot keep up with the demand for products in the world?

Investing in Brazil is undoubtedly an option. But stop and think: would you do that? Would you invest in the long term in a country like ours, which is sinking into economic instability with its own legs? A country that, according to the IMF, will have a 3% drop in the economy and that forecasts a budget for 2016 with a deficit of more than R $ 30 billion?

If you were Tim Cook or Luca Maestri (CEO and CFO of Ma, respectively), seeing your company grow 28% in the last fiscal year, with records after records, would you be concerned about Brazil?

In 2010, Washington Fajardo (at the time in front of the Rio de Janeiro Heritage Secretariat) had invited Steve Jobs to open the first Apple store in Brazil (in Rio de Janeiro in the Port Zone or in a historic building in the Center). The late Apple co-founder declined the invitation:

We can't even export our products with Brazil's super-high rate crazy policy. This makes investing in the country very unattractive. Many companies high tech feel that way.

Since then, a few things have changed Apple, including opening two stores in our country. However, it is simply impossible to deny that Jobs's phrase remains very, very current.

cliché, but unfortunately the desire to have good prices for Apple products in our country depends much more on stability, on the strength of our economy, than on Apple itself. While Brazil is in a crisis, with its currency devalued, raising import and interest taxes, with inflation above, etc., Apple is doing very well and does not see the least need to do “charity” for us, Brazilians yet more because we continue to actively buy your products.